Interested in this kind of news?

Receive them directly in your inbox. Delivered once a week.

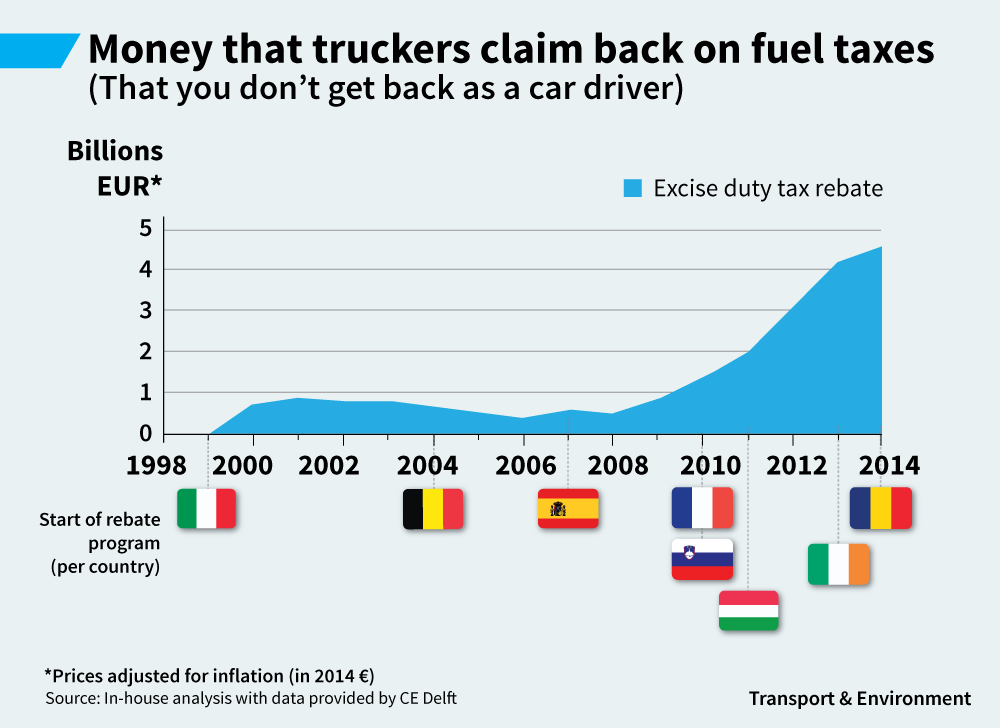

It also finds that trucks pay on average €0.44/l diesel tax in the EU now, €0.04 below the rate cars pay and 15% below the inflation-corrected €0.52/l they paid in 2000. Truck diesel tax rebates totalled around €4.5 billion in 2014, up from €0 in 1999. The number of countries giving fuel tax rebates to hauliers has gone up from only one in 2000 to eight now.

T&E recommends that in the short term Europe revisits the 2007 Energy Tax Directive proposal, and raises the general minimum level for diesel significantly, and correct it for future inflation. In the long term a system similar to the International Fuel Tax Agreement (IFTA) between Canada and the US, which enables states and provinces to tax truck diesel on the basis of where the trucks drive not where they fill up, should be implemented.