Interested in this kind of news?

Receive them directly in your inbox. Delivered once a week.

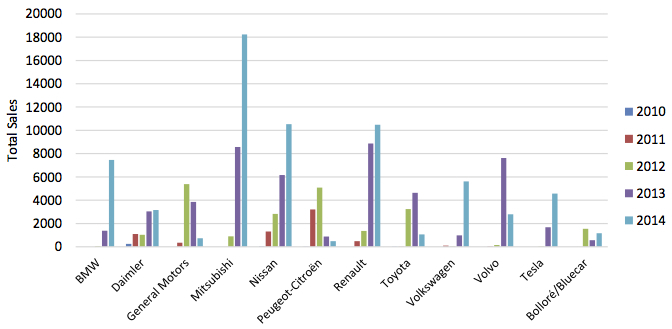

Mitsubishi passed 18,000 sales in 2014 to become the clear leader in the field, while Nissan and Renault exceeded 10,000 for the first time (see graph). BMW and Volkwagen also had substantial showings, followed by electric-car specialist Tesla.

Graph: Yearly progress in EV sales by manufacturers

The Mitsubishi Outlander was the top-selling EV, partly due to very generous benefit-in-kind tax rates it enjoys in some countries, as well purchase subsidies and low – or even zero – annual circulation tax rates. It beat the Nissan Leaf and Renault Zoe into second and third place.

T&E said the absence of many carmakers from the EV market highlighted the need for a future CO2 regulation to include a sub-target for supplying ultra-low-carbon vehicles to increase consumer choice and encourage the development of new business models such as electric car sharing.

The report also found that supercredits, which give manufacturers additional allowances for selling electric cars, only conferred a significant benefit on Mitsubishi and Nissan and these had already exceeded their 2015 targets without the additional credits.