Interested in this kind of news?

Receive them directly in your inbox. Delivered once a week.

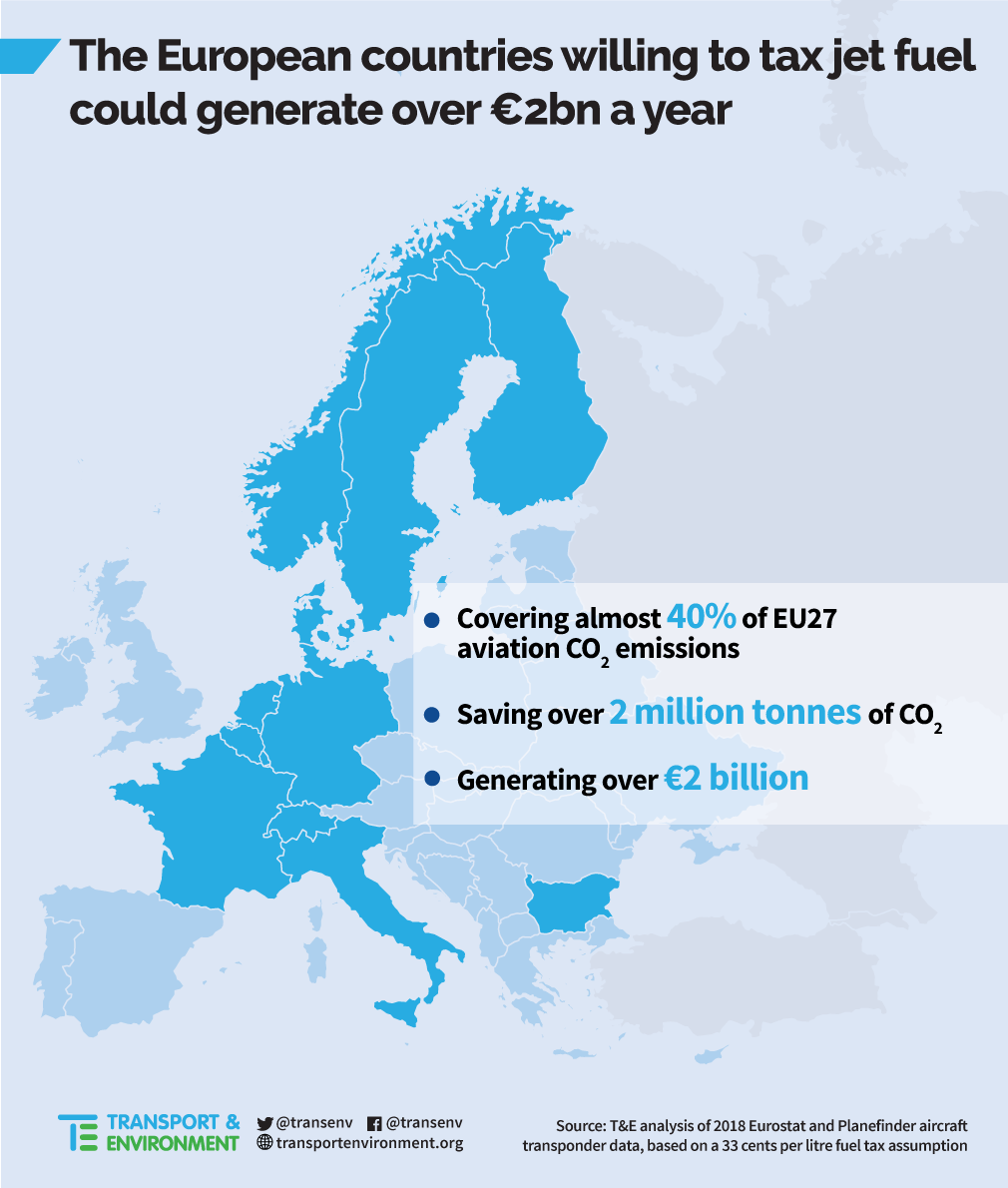

This debate will include the tax exemption for aviation, a sector responsible for 3.7% of total EU emissions – its CO2 having grown 26% in the past five years. Amending the Directive will require unanimity in Council, but in the interim some EU countries are considering taxing jet fuel bilaterally. T&E analysis finds that the European countries willing to tax jet could generate over €2 billion a year in revenue. (See methodology below.)

The meeting takes place in Brussels, beginning at 09.00 CET tomorrow (Thursday, 5 December 2019).

WHAT WILL THE DEBATE FOCUS ON?

• Earlier this year the Finnish presidency highlighted that the tax exemption for aviation was not in line with the EU’s decarbonisation objectives. Prompted by the Netherlands, EU ministers started addressing the question of aviation taxation and carbon pricing during the July ECOFIN meeting as well as at an informal meeting in September. But some member states, such as Greece, Cyprus and Malta, reportedly remain opposed to ending the EU-wide kerosene tax exemption for the aviation sector.

• The debate will now focus on adopting draft conclusions on the ETD, highlighting the areas which need to be changed to meet the EU’s climate and energy goals. But these conclusions remain weak when it comes to addressing the EU-wide kerosene tax exemption for the aviation sector.

• The draft does not specifically call for the removal of the exemption, but only to “take (it) into consideration” when the Commission prepares its future proposal while “recogni(sing) the importance of flexibility” for member states.

WHAT ARE FINANCE MINISTERS EXPECTED TO AGREE?

• Despite the ambition to bring energy taxation schemes in line with EU climate objectives, T&E sees these conclusions as a first step to support better pricing of the aviation sector. The reluctance by some member states to address the tax exemption for jet fuels is expected to result in a coalition of countries which are willing to push ahead with bilateral taxation agreements already today.

• The ETD already allows two or more member states to implement a kerosene fuel tax for intra-EU flights taking place between those countries, and the Chicago Convention (Art. 24) does not prevent taxing fuel which is “uplifted”, ie. bought on the territory of an EU member state.

WHAT WOULD BE THE BENEFITS OF BILATERAL TAXATION OF JET FUEL?

• T&E has conducted an analysis of the positive economic and environmental impacts taxing jet fuel would have if a coalition of European countries decide to implement a 33 cent/litre tax on kerosene.

• The European Commission already found in June 2019 that taxing aviation kerosene sold in Europe would cut aviation emissions by 11% and have no net impact on jobs or the economy as a whole while raising almost €27 billion in revenues every year if applied to all flights within and departing from Europe.

• The emissions of all flights departing from EU airports have grown from 1.4% of total EU emissions in 1990 to 3.7% today. If unmitigated, aviation emissions are expected to double or triple by 2050 and in doing so consume up to one-quarter of the global carbon budget under a 1.5 degree scenario.

Methodology:

– The countries included in our analysis are the ones who signed the recent political statement on aviation pricing, as well as Finland. (Despite it not signing the letter due to its impartial position while holding the presidency, Finland has previously stated a preference for taxing the aviation sector.)

– Norway and Switzerland are also included because they have implemented jet fuel taxation domestically, so they could be part of a wider coalition for jet fuel taxation.

– The reduction of the number of passengers due to the implementation of the tax was taken into consideration. The UK was excluded from our calculations due to Brexit uncertainties.

– Outermost territories were excluded from the calculation, as well as Canaries Islands, Azores and Svalbard (Norway) given they are not included in the current scope of the ETS.

CONCLUSION and NEXT STEPS:

• These Council conclusions only outline the main issues which member states expect the Commission to look into. But Vice-President Frans Timmermans’ future ‘European Green Deal’ and proposal to revise the ETD are expected to address the kerosene tax exemption specifically, as stated in his answers to European Parliament questions.

• The revision of the EU ETD will require unanimity in the Council. T&E encourages those member states already willing to tax jet fuel to engage in bilateral taxation schemes in the interim, pending unanimous approval by the Council to remove the exemption EU-wide.

T&E’s COMMENT:

Jo Dardenne, aviation manager at T&E, said: “The countries already willing to end aviation’s tax holiday mustn’t be held back by a few member states. These progressive countries should agree bilaterally now to tax aviation, which could bring in over €2 billion and save 2 million tonnes of CO2. The work towards an EU-wide tax can continue in parallel.”