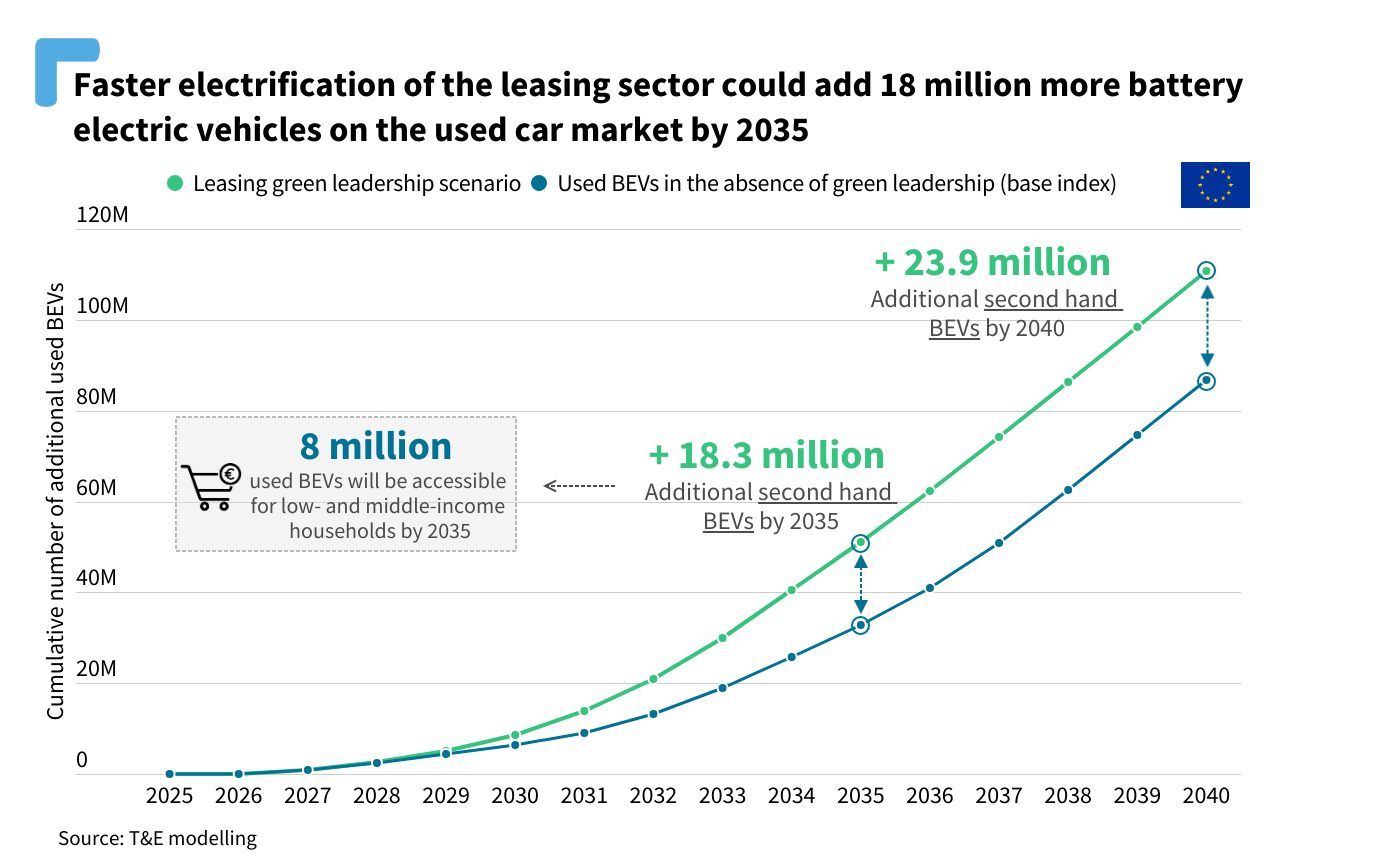

At current rates of electrification, 33 million households in the EU will have access to second hand electric cars from today until 2035. But if the leasing sector accelerates its uptake of EVs, this would go up by 56% – up to 51 million, a new report by Transport & Environment (T&E) finds[1],[2]. These 18 million additional households would be saving money on their car spending.

The leasing sector constitutes an important channel for cars on the used car market. Four in ten cars entering the second-hand market every year in the EU come from the leasing sector[3]. If leasing companies electrify faster, they will accelerate the pace with which the second-hand market goes green. That’s why T&E calls upon Europe’s top seven leasing companies to commit to a phase-out of fossil fuel cars and to lease battery electric vehicles (BEVs) only as of 2028. The sector as a whole should do this by 2030.

Today, almost eight out of ten EU citizens buy their car second-hand. Around 90% of low and middle income groups buy their cars on the used car market[4]. Even among higher income groups, the percentage is still significant (62%).

A second-hand battery electric vehicle has much lower ownership costs than a used petrol car, a study by consumer group BEUC has found. Households can save almost €6,000 over 7 years by going electric rather than buying petrol[5]. That’s why a steady influx of electric cars on the second-hand market is so important for European families looking to save costs, T&E says.

“The mass influx of affordable electric cars on the second hand market is possible… and leasing companies hold the keys to this. If they go green faster, European families will go green too – for a smaller cost. It’s no understatement to say that leasing companies can accelerate and democratize the electric car for the 80%. Their duty is both environmental and social, ” Stef Cornelis concludes.

Eight million used EVs for €10,000 on the roads

If the leasing sector starts leading instead of following the market in terms of uptake of battery electric cars, this could bring 18 million more second-hand BEVs on the market by 2035, the study finds. Importantly, 8 million of these cars would cost €10,000 or less to buy – which is the average price low- and middle-income households pay for a used car.

But T&E research has shown that despite claims of green leadership, leasing companies are not moving fast enough on the transition to electric cars. For example, not one of Europe’s largest leasing companies has set a date to phase out fossil cars and the uptake of battery electric vehicles is merely in line with the overall market. A T&E undercover investigation in France and Germany also finds that leasing companies’ sales staff are not always helping their customers go electric.

[1] A scenario whereby leasing companies do not electrify is the outcome of following the EU’s CO2 standards of cars.

[2] T&E has modeled the impact of faster electrification of the leasing sector, by assuming that the top seven leasing companies will stop leasing fossil fuel cars by 2028 and the rest of the sector by 2030.

[3] Assuming a three to four year ownership period.

[4] Vanherle, K. and Vergeer, R. (2016). Data gathering and analysis to improve the understanding of 2nd hand car and LDV markets and implications for the cost effectiveness and social equity of LDV CO2 regulations. DG Climate Action (link)

[5] BEUC (2021). Electric cars: calculating the total cost of ownership for consumers (technical report) (link). Data for third ownership period.