The car CO2 regulation is the single most important measure to reduce emissions from new cars in Europe. Thanks to this regulation, the CO2 emissions from new cars in the EU have been reduced by 28% since 2019. In 2025, the next stage of the regulation comes into force with a 15% reduction compared to the emissions baseline in 2021.

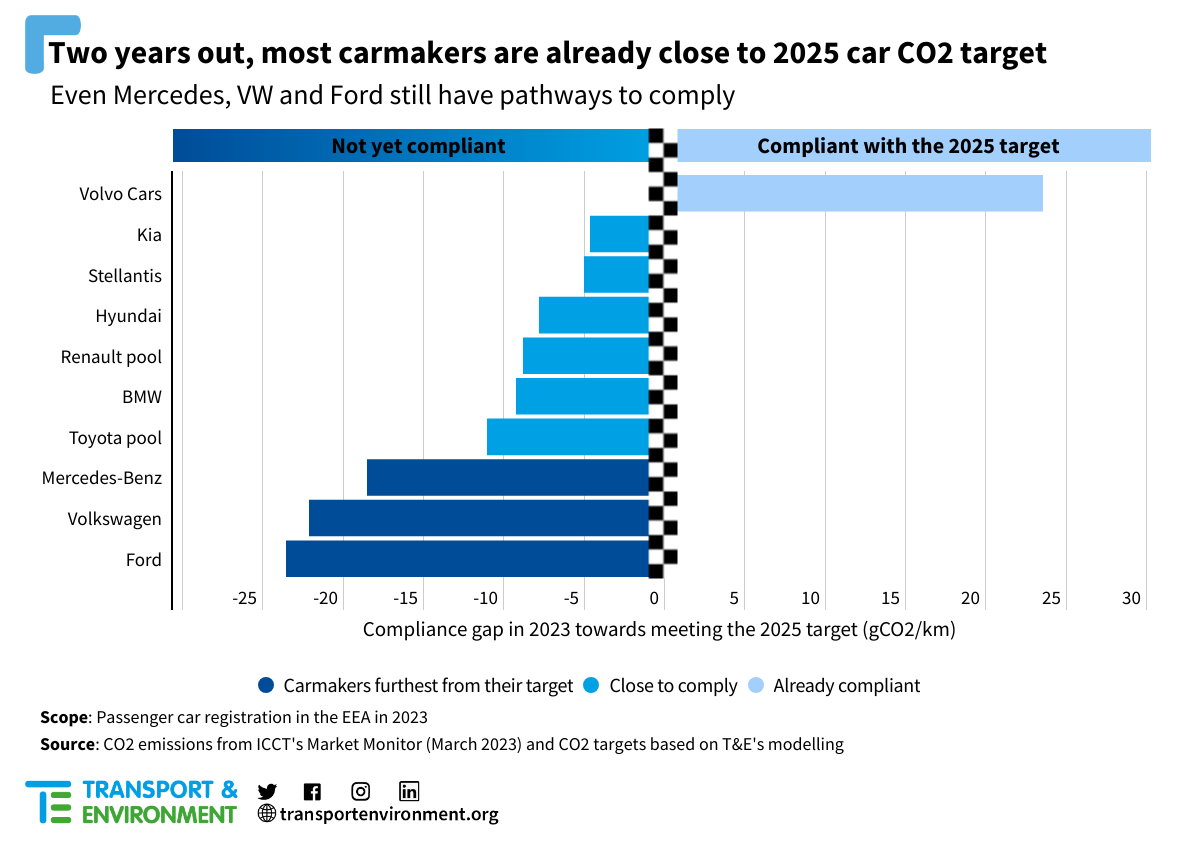

T&E has estimated carmakers’ compliance gap with this 2025 target based on their emissions in 2023. The analysis shows that Volvo Cars would already meet its 2025 target based on its 2023 sales, while carmakers such as Kia or Stellantis have a gap of less than 5 gCO2/km and therefore appear to be well on track for their 2025 targets. Volkswagen and Ford are at the bottom with the largest gap at 22 and 24 g/km respectively and will need to redouble their efforts to meet their targets.

The key lesson from the 2020/21 target is that, despite carmakers being below the target in 2018-2019, they all met the target (or only missed it by a small margin). This shows that it is difficult to predict a carmaker’s ability to meet a future target by looking at the progress made in the previous two years. However, what is clear is that carmakers have known the 2025 target since 2017 and have all prepared and adjusted their strategies to comply in 2025.

There are multiple strategies and flexibilities that carmakers can and are leveraging to meet the targets, ranging from higher BEV sales (the best long term strategy), to higher efficiency from combustion models to pooling emissions across a number of manufacturers. Carmakers can also do a lot to adjust their sales by adjusting prices and dealer incentives, or plan new models and variant availability for when they need to sell more EVs. However, many carmakers are currently prioritising larger and more expensive vehicles. These heavier vehicles are more polluting but offer higher profit margins. As a result, the lack of affordable EV models is holding back EV sales which explains some of the current significant gaps to the 2025 targets. After years of profits, it is high time for OEMs to launch affordable mass market EV models and adjust their pricing to incentivise their cleanest vehicles.

If carmakers do not improve their ICE sales compared to 2023, they would need to sell 24% BEVs in 2025. In addition to introducing new BEV models, carmakers can also sell more hybrids or downsize the most polluting models. In this case, the average BEV sales share could be reduced to 18% to meet the 2025 targets. Carmakers can also choose to “pool” their sales as Honda, JLR and Tesla did in 2022. Volvo Cars and Tesla could be candidates for pooling in 2025. If the carmakers such as VW, Ford and Mercedes pooled their sales with the top of the table (Tesla and Volvo Cars), the BEVs those three carmakers have to sell would decrease by 36%.

Putting this into perspective, the 2025 target is an easy one as it was limited to -15%, proposed in 2017 and left unchanged in the 2023 review as a compromise on the way to a higher 2030 ambition under the EU Green Deal. Given the global race to dominate the EV market, relaxing the one policy that drives European OEMs to invest in electrification would go against European industrial and sovereignty interests.

If the EU chooses to weaken its regulation or waiver the fines, it risks discrediting the EU’s climate agenda and rules, and leave European carmakers at the mercy of the ambitions of global carmakers. Instead of questioning the rules, European carmakers should do the right thing for the climate and the EU economy and step up their efforts to comply and show that they are fully committed to the transition to electric.

To find out more, download the briefing.