Will electric trucks take charge?

This is the final in a blog series on how to decarbonise land freight by 2050. All the blogs are based on our report Roadmap to climate-friendly land freight and buses in Europe, leading up to a public debate, Zero emissions land freight, taking place in Brussels on 27 September.

Interested in this kind of news?

Receive them directly in your inbox. Delivered once a week.

After publishing our report on climate-friendly freight and buses in June, three months later seems soon to release an update. But things are moving fast. Cummins released a concept electric truck at the end of August. BYD has ramped up its offering of smaller electric trucks in the US and Asia. Tesla is due to unveil a long-haul electric truck in Los Angeles on 26 October.

Already, Tesla’s big bet on battery electric vehicles has transformed the automotive sector. Tesla has shown that battery cars which customers desire can be produced at reasonable cost and, last – but not least – carmakers planning to penetrate the market in a serious way need to help roll out charging infrastructure. European manufacturers are scrambling to catch up.

But Tesla’s announcement of a battery electric highway truck left many die-hard fans head-scratching. Conventional wisdom is that a 40 tonne long-haul electric truck would be too expensive, too heavy and ill-suited to truckers’ operational needs.

It remains to be seen if Tesla can disrupt truck-making. But it’s worth pointing out why the idea can’t be dismissed. First, Tesla isn’t the only company saying battery trucks make sense. Mercedes announced a 26 tonne delivery truck last year, and MAN, a Volkswagen subsidiary, is also working on a battery truck. But the most clear and compelling summary of why battery trucks might actually make a lot of sense comes in a series of blogs from Auke Hoekstra, senior advisor at the University of Eindhoven.

First and foremost is cost. Road transport is dominated by cost. If battery trucks are more expensive than diesel trucks they won’t succeed. Tesla’s battery pack costs are rumoured to be below $160/kWh. And that’s before factoring in the massive scale effects of its gigafactory. Bloomberg and McKinsey expect battery pack costs to drop below $100 by 2030, while projections from the ICCT are in a similar range. Put simply, between the mid 2010s and mid 2020s, battery costs will roughly halve – and the additional contribution of the new generation of post-lithium ion batteries coming on stream is still very difficult to quantify. And that’s not the full story, even on batteries: truck-builders may lease rather than sell the battery back, delivering day-to-day energy cost savings even more directly to the transport operator.

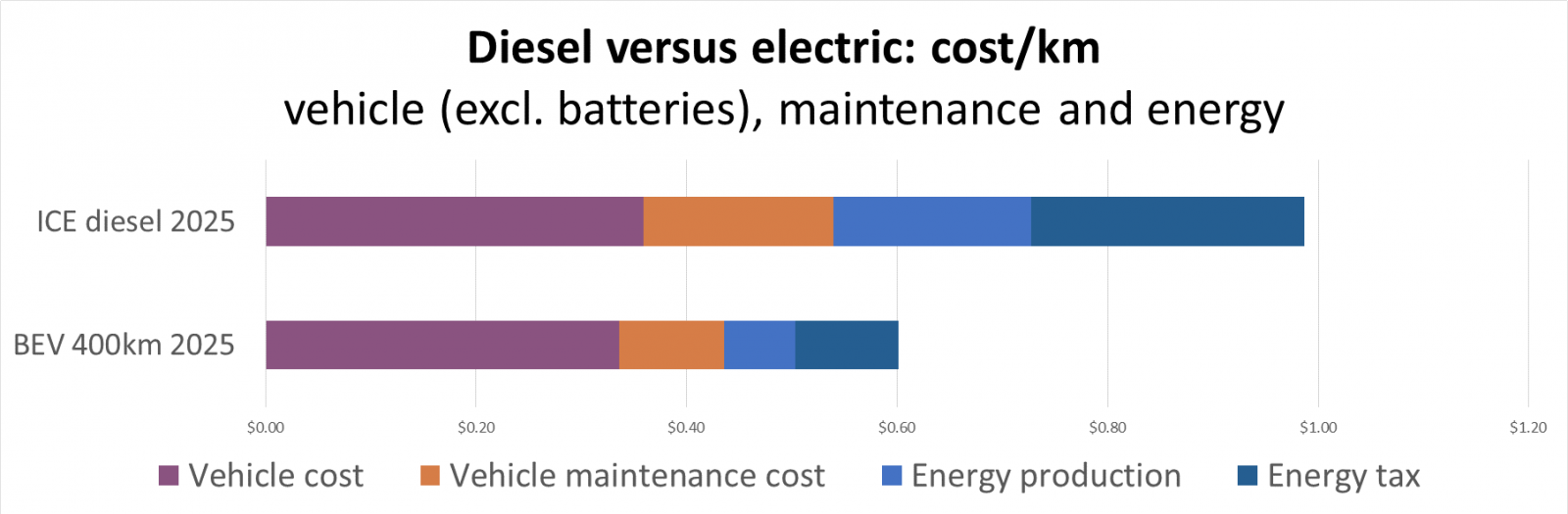

Doing away with the engine, after-treatment, and the complex transmission that comes with diesel all yielding big ticket savings. Battery trucks run on super-efficient electric engines with almost no maintenance costs. According to Hoekstra, battery trucks would be around one third cheaper to run. Knowing a trucker spends around 30-40k on diesel every year, it’s clear from his work that the big savings are on the energy side:

A battery truck won’t be as heavy as often feared. Yes, the battery could add 4-5t tonnes of weight, but this needs to be set against the removal of the diesel engine, together with weight savings on the powertrain side. Combined with the significant opportunities for light-weighting (e.g. using more aluminium or carbon fibre), the weight of the batteries could be far less of a problem.

The big remaining question is: how suited to truckers’ needs will battery trucks be? As the update to T&E’s study will show, 48% of truck journeys in the EU are shorter than 300km (the update will be released on 27 Sept). For longer journeys, companies would need charging stations to be installed on their premises or in highway service stations. If the rechargers are big enough (up to one megawatt), charging times would be quick. Lack of this infrastructure will initially limit battery trucks to predictable routes, ideally returning to the same base. But, if the economics are favourable, electric trucks will start to gain market share quickly. And, if politicians remove uncertainty regarding the investment timeframe for charging stations, the pace of penetration will pick up.

All of this suggests a much brighter future for electric trucks. To date, truck manufacturing has been a very conservative business, even more wedded to diesel than car manufacturing. Truck-makers have had few reasons to develop alternative powertrains. That means policy support will be needed to bring road freight emissions to zero.

The EU is preparing CO2 regulation for trucks and buses. Its focus is – and should be – efficiency. A recent report by the ICCT showed trucks could be around 43% more efficient with a reduced total cost of ownership. But the CO2 regulation must be forward-looking and support trucks and buses with zero tailpipe emissions. It can do so in three ways:

– zero-rate electric and other zero-emission (capable) vehicles

– avoid multipliers (supercredits) for battery vehicles and instead extend the planned Zero Emission Vehicle (ZEV) mandate for cars and vans to also include trucks and buses, and third

– use the EU’s post 2020 budget to electrify, or further electrify, freight transport systems.

Alongside the points above, progress on three additional initiatives is needed. First, the EU needs to adopt the Commission’s proposed toll discount for zero emission vehicles (already set out in the draft revision of the EuroVignette Directive); second, ensure Europe’s procurement authorities lead the way on zero emission transport with a progressive revision of the Clean Vehicles Directive; and third, reform the Energy Tax Directive to increase Europe’s minimum diesel taxes.

Put this six-part package in place and the EU will have the world’s most progressive framework for zero emission heavy duty vehicles. And that is exactly what Europe needs. I admire Elon Musk, but I want to see Europe – and its world-leading truckmakers – win the race for zero emission road transport.

How is the European team shaping up? To hear the views of Europe’s main players – from the makers of electric road systems, batteries and hydrogen, to regulators, operators, and technology experts – come to Zero Emissions Land Freight on Wed 27 Sept, a Nordic Council of Ministers event, in partnership with T&E. There you can decide if Europe is positioning itself to lead – or fall behind.