Interested in this kind of news?

Receive them directly in your inbox. Delivered once a week.

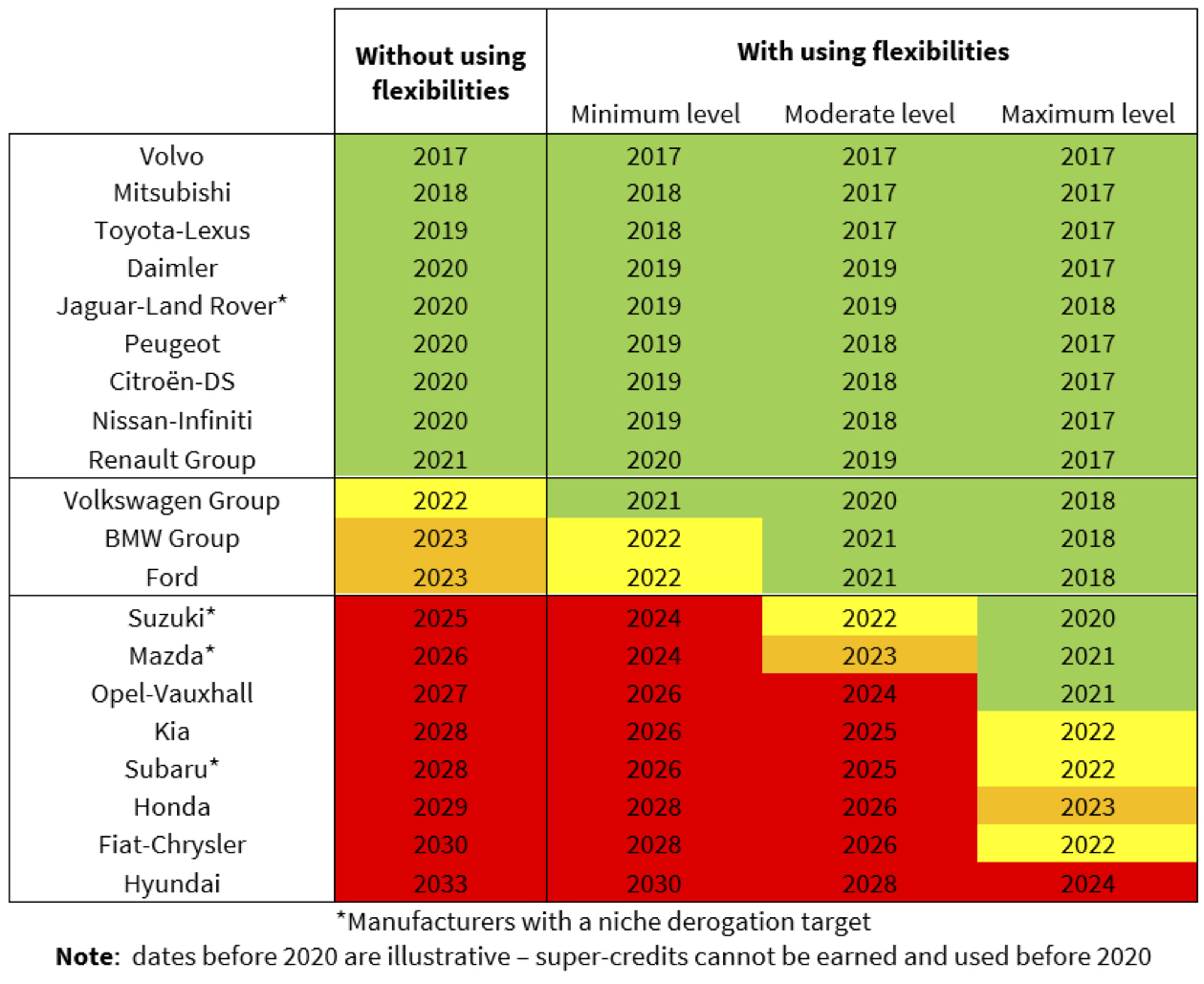

Nine carmaker groups are on track to achieve 2020 and 2021 targets on time without using flexibilities, according to the projections: Volvo, Mitsubishi, Toyota-Lexus, Daimler, Jaguar-Land Rover, Peugeot, Citroën-DS, Nissan-Infiniti, and Renault Group. In reality, most of these companies will comply even earlier by availing of flexibilities, which include credits awarded for eco-innovations such as LED lights or efficient alternators and super-credits given for selling low-carbon vehicles.

The Volkswagen Group, BMW Group and Ford will meet their targets on time by using a minimum or moderate level of flexibilities. Of the European carmakers that have failed to make sufficient progress to date, Opel and Vauxhall could pool with Peugeot and Citroën, which are also owned by PSA Group and have performed strongly to date. For Fiat-Chrysler, it will be essential to start selling significant numbers of sub-50g/km vehicles to avoid fines.

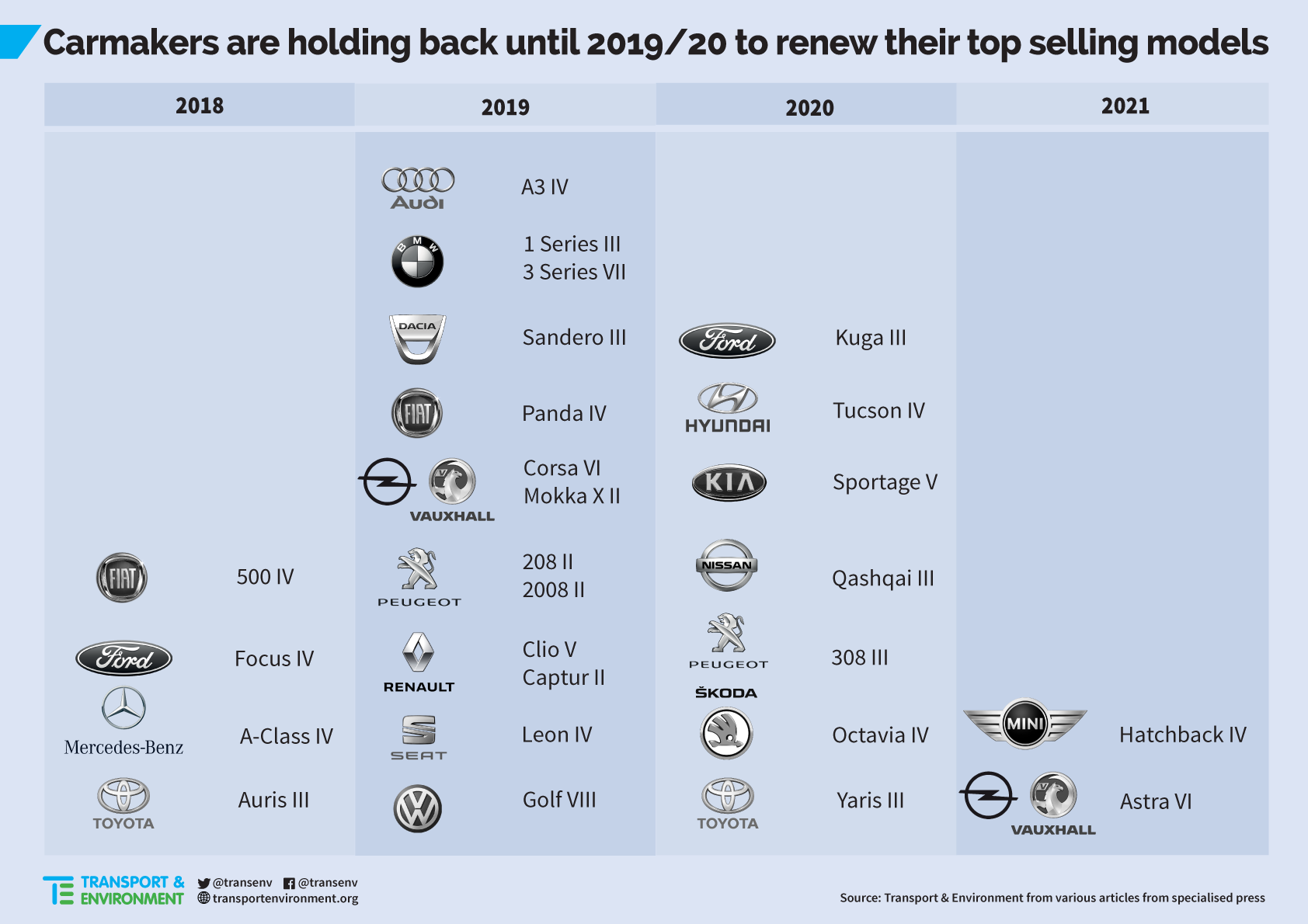

The projections also reveal carmakers’ strategy of not making gradual CO2 reductions to comply with their targets by 2021, but instead back-ending the effort – both in terms of efficiency improvements and sales of sub-50g plug-in vehicles that earn supercredits. T&E’s analysis also finds that launches of new electric car models and more fuel-efficient upgrades of top selling models are being held back until 2019 and 2020.

Only six of the top 50 selling models in Europe received a full model upgrade in 2017 and very few new plug-in cars were made available – undoubtedly contributing to the lack of progress in reducing car CO2 emissions in 2017 just reported by the European Environment Agency. Just four of the top-selling 50 models are set to be fully upgraded by the end of this year, followed by 14 in 2019, and seven in 2020. This tactic of continuing to sell old models for as long as possible makes it clear that carmakers are both optimising profits and trying to deceive regulators that they will struggle to hit the 2021 CO2 targets.

The report also finds that rising sales of SUVs – the market share of which increased from 4% in 2001 to 26% in 2016 – as well as more powerful engines have been largely responsible for rising car emissions.

T&E’s clean vehicles director, Greg Archer, said: ‘Carmakers are shameless, crying wolf that they can’t meet their CO2 targets and blaming declining diesel sales, while pushing old, inefficient, high-performance SUVs to maximise their profits. As a result CO2 emissions are rising and their customers are hit with higher fuel bills. But the reality is almost all serious carmakers in Europe will hit their targets and avoid fines.’

As a result of the manufacturers’ strategy to comply, battery electric and plug-in hybrid vehicles are likely to increase their European market share significantly to 5-7% by 2021. There are only 20 battery electric cars on sale at present but by 2021 this is expected to leap to reach more than 100 if companies deliver on their announcements.

Greg Archer concluded: ‘Carmakers are desperately trying to persuade regulators to drop the planned 2025 car and van CO2 targets completely and set even easier 2030 goals. The plan is to keep selling diesels in Europe for as long as possible. Politicians should not be fooled by their cynical strategy and must instead demand ambitious 2025 targets, a mandate for electric vehicle sales as well as guarantees that emission reductions happen in the real world and not just in carmaker labs.’