Driven by climate regulations and technological innovation, the automotive sector is swapping the combustion engine for emissions-free electric vehicles (EVs). Despite the resistance of the industry and the reluctance of some policymakers to move faster, investors have supported the development of new EV businesses like Tesla, which is now worth more than the 10 top legacy carmakers combined. Faced with low market valuations, established companies like Volkswagen (VW) and Ford now plan to plough dozens of billions to accelerate their EV strategies in an attempt to catch up. The question isn’t, anymore, ‘if’ one should electrify the entire fleet, but ‘by when’. European decision-makers are pondering this very question, as part of the EU Cars CO₂ review.

In the industry narrative a fast transition is associated with financial strains, job losses, and potential bankruptcies. The framing of the discussion is, yet again, an obsolete ‘environment vs. economics’. T&E has decided to unpack this narrative and to look exclusively at the financial and business case of the ‘slow vs. fast’ phase out of combustion engines (ICE).

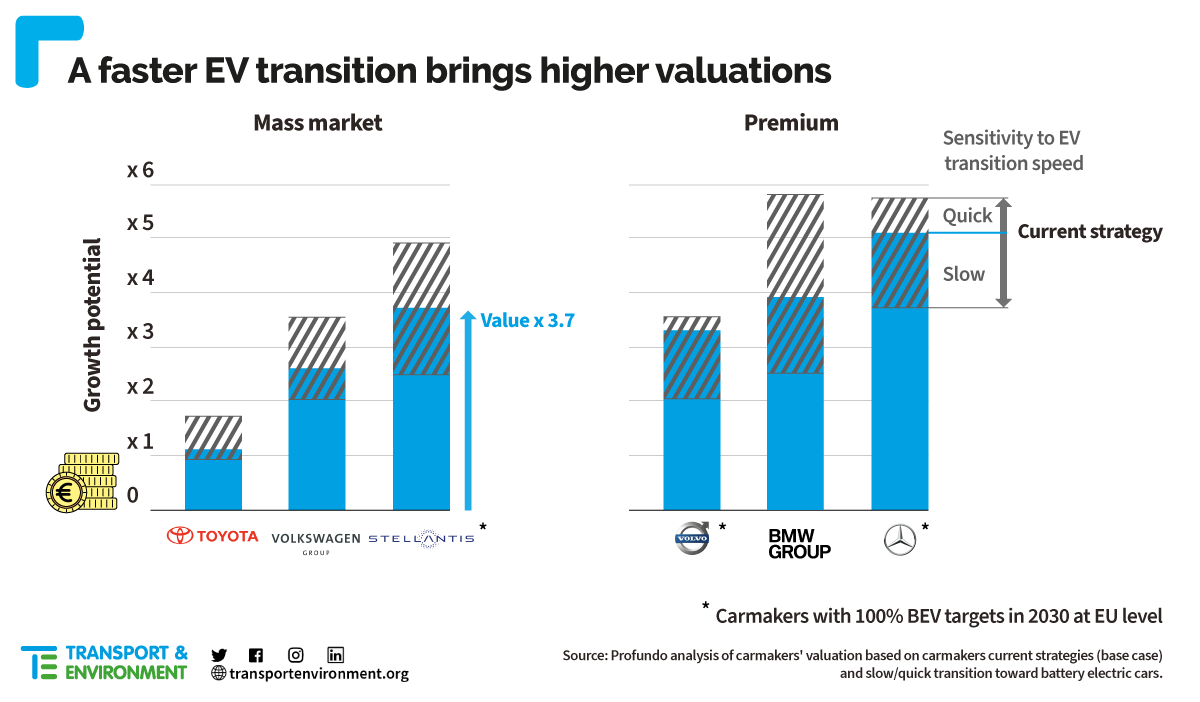

To do this, T&E commissioned a financial analysis from Profundo, an external research outlet, and used the best available data from S&P, Bloomberg and MSCI. Profundo has analysed financial data of six car manufacturers: three mass market car companies (VW, Stellantis and Toyota) and three premium carmakers (Volvo Cars, Mercedes-Benz and BMW). Based on companies’ financial figures, strategic plans and market trends, an in-depth analysis was done for VW as representative of the market average, then a similar methodology was applied to others to understand the relationship between the speed of ICE phase-out and companies’ market value was performed in three scenarios: Base (current EV plans), Slow (only half of EV plans realised) and Quick (faster switch to EVs in 2025-2030).

This work has set aside all environmental, climate and health issues to focus exclusively on the financial and business aspects of the transition.

The findings can be summarised as follows:

- Profundo, using standard Sum Of The Parts (SOTP) analysis and Discounted Cash-Flows (DCF), shows that a quick EV transition by the six legacy car manufacturers could bring a EUR 800 billion equity value enhancement compared to a slow switch to EVs. Quicker rather than slower EV transition strategies in the 2020s are projected to generate higher margins, triggering higher equity value for shareholders as well as better access to capital.

- On average, the Quick transition scenario (i.e. faster ramp up in 2025-30 than current plans) shows a 316% growth potential compared to current market values, with mass-market carmakers multiplying their market value threefold and premium carmakers reaching a fivefold increase.

- In the Base case (based on carmakers’ EV commitments), carmakers with plans to phase-out combustion engines by 2030 in mature markets have the highest potential: Stellantis’ market value could grow by 270% and Mercedes-Benz’ by 410%. However, these EV commitments remain voluntary so it remains a question whether carmakers will achieve the projected financial gains. The value growth potential is lower for laggards such as Toyota. Volvo Cars having a lower growth potential in this analysis could be explained by the fact that the company is already reaping the benefits of an aggressive ICE phase out policy, and is currently valued twice compared to the others.

- The Slow EV transition, contrary to the beliefs held by some policy-makers, results in the lowest market capitalisation growth of companies, or even decreases in Toyota’s case. This scenario is a likely possibility. In fact, many carmakers including VW and Mercedes, have announced they are currently sold out on EVs. This not only shows that consumer demand is stronger than expected, but that carmakers planned to produce minimum EV supply as required by regulations instead of maximising the EV transition benefits.

- Best available market data suggests that electric cars will have superior profit margins in coming years, while diesel and petrol cars are expected to suffer as their market share and pricing power shrink. The analysis finds that EV business operating margins are expected to reach and surpass those of conventional cars in the next 3-5 years.

- Towards the late 2020s, ICE operating margins are estimated to decrease and even become negative (on balance sheets) as ICE sales prices fall due to competition from cheaper battery electric vehicles (BEV) or due to phase-out in various markets, and because of decrease in economies of scale.

- Car companies are generally valued very poorly by financial markets. If one looks at the top 10 world producers, their Price Earnings ratios (P/E) are among the lowest in the market, with an average of 5x. Oil and cement companies appear to be more popular. When looking for reasons to explain such poor evaluations T&E has plotted OEM’s evaluations against their carbon intensity, expressed as total emissions per one million of capital invested. Despite the emissions figures used being the official ones, which an upcoming study by T&E will show are substantially underestimated (by 20% to 68%), the observed relation is quite startling. The fitting explains nearly 80% of the negative relation (higher carbon per million, lower evaluations). Market action suggests that investors reward emission reduction per unit of capital exponentially. Our fitted curve seems to indicate that above 1,000 CO₂e tonnes emitted per million of equity, companies enter a ‘carbon trap’ where they are relegated to low evaluation.

The ‘carbon trap’ curve seems to indicate that the only way OEMs have to increase their value is to cut emissions aggressively and quickly, changing their product mix, since 98% of their emissions are indirect (the use of sold goods) and mostly unrelated to the industrial process.

Conclusions

- Contrary to the common narrative that ‘slow is better and more humane’, it is the faster ramp up of EV supply up to 2030 that will help car companies to preserve sound financials and protect employment in the sector. This financial analysis indicates that a fast transition is the only chance to keep companies ‘whole’ and allow a socially acceptable conversion to a new product: a case of allowing a painful cure now, to avoid the loss of entire limbs tomorrow.

- The harsh reality described could easily surpass the modelling as slow movers will potentially face higher carbon emission liabilities due to larger ICE fleets, as cities, entire regions and countries restrict or block the access of combustion engines, and as carbon taxes are introduced.

- The analysis, and recent media announcements by Ford and Renault, suggests that, with diverging valuations (and multiples) between the EV and ICE business, the temptation to spin off the EV business units will get increasingly hard to resist. This ‘shortcut’ to higher valuations would create a number of ‘bad companies’, left adrift with their stranded ICE assets, with potentially catastrophic social consequences in Europe in the medium term.

- Regulation – such as Car CO2 standards – should ensure carmakers at least meet their EV commitments, which remain voluntary and often not backed by industrial plans to achieve those. If not, OEMs risk both losing market share and miss out on potential value increase. If carmakers go slow on EVs, they will be trapped in a downward spiral and lose investors’ confidence.

Recommendations

- The analysis suggests that the only chance to keep most legacy OEMs ‘whole’, and to protect employment in the sector, seem to lie with policies that encourage a fast transition. In Europe, these are the EU clean car rules, of Car CO₂ standards, for 2025 and 2030. The current standards will require little progress until 2030. And the long waiting times for EVs in Europe today suggest that carmakers will not go beyond these weak rules, so likely will follow the Slow transition. But as the Profundo study shows, 2030 will be too late to make the switch. The risk is that American and Asian carmakers will have captured large parts of the EV market by then (and many investors with it). This analysis shows that a faster transition is not only in the interests of the climate and consumers, it is also at the heart of industrial success and financial viability of European automakers.

- Producing electric cars early – i.e. accelerating in 2025-2030 – has many advantages beyond the financials. First, it is an opportunity for new players to establish themselves in the global market, best exemplified by Tesla that grew their market share from 0.1% five years ago to 1.8% in 2022. Second, going early allows traditional carmakers to secure their market share in the growing market: VW is not only reaping economy of scale gains thanks to its modular car platform dedicated to BEV but is also licensing it to other OEMs to manufacture electric cars. Accelerating now also allows one to gain advantage in securing supply chains and raw materials, as well as building consumer trust early on.

- Higher car CO₂ targets in 2025-2030 are also needed to ensure EU carmakers stay ahead of the competition. Chinese carmakers were nearly absent on the European market in 2018, but reached 2.8% of the BEV market in 2020. Despite the fact that European customers were largely unfamiliar with Chinese brands and had preconceived ideas related to quality and safety. It is a sign of a supply gap in the market, as EU OEMs are slow to ramp up the supply to match the demand for EVs.