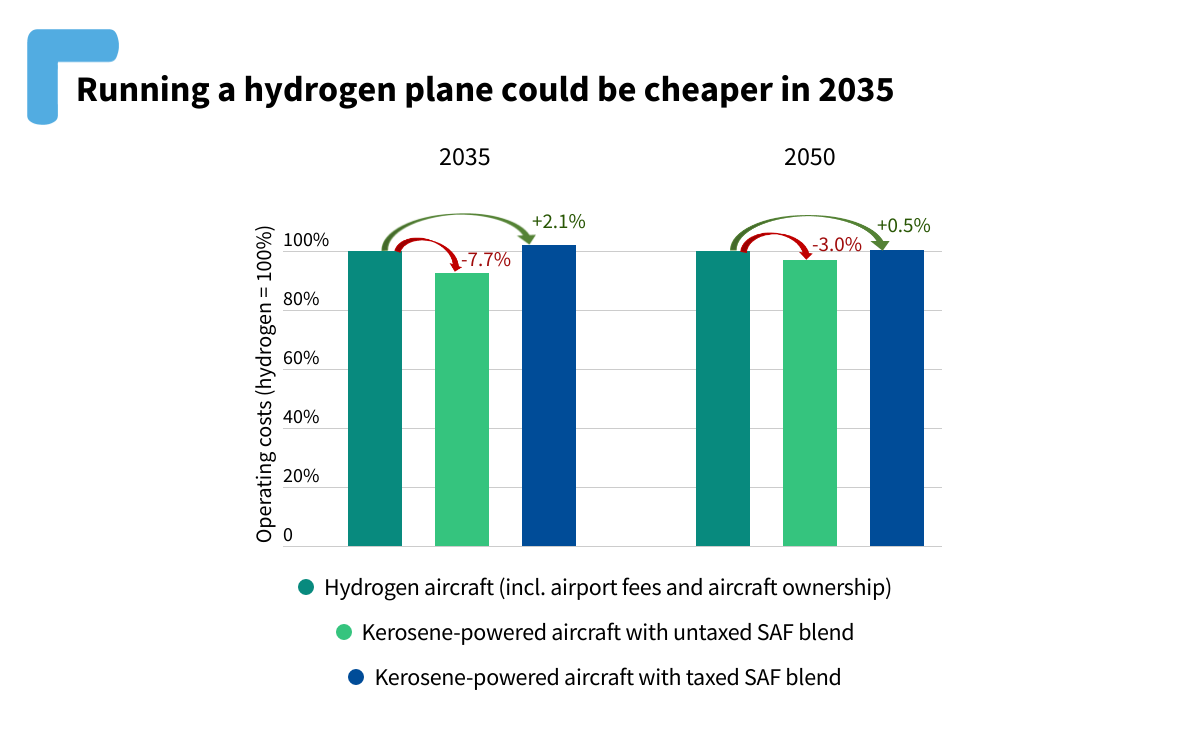

Hydrogen jets could be cheaper to run than fossil fuel planes from 2035 provided kerosene is taxed adequately, a new study shows[1],[2]. In 2035, running planes on hydrogen could be 8% more expensive than using kerosene. But with a tax on fossil jet fuel and a price on carbon, hydrogen planes could become 2% cheaper to operate than their kerosene counterparts. These pricing measures are key to the deployment of green technologies like hydrogen planes, T&E says.

An economic study by research group Steer, and commissioned by T&E, looked at future operating costs of hydrogen planes on intra-European flights and found that they could be an efficient, cost competitive technology to decarbonise the sector.

But aircraft manufacturer Airbus, which has launched three concepts for hydrogen planes, is yet to prove it will be able to meet its planned 2035 launch date for its plane. It has warned that the slow development of the hydrogen ecosystem could delay the launch of its zero-emission planes. Airbus has also opposed a criteria in the EU taxonomy – the EU’s list of sustainable investments – whereby only zero emission aircraft would get a green investment label. This suggests Airbus doubts it will sell many of these aircraft, T&E says.

Carlos López de la Osa, aviation technical manager at T&E, says: “Airbus promised the world it would build a hydrogen jet by 2035. Building these planes is economically feasible, but if we want Airbus to walk the talk, we’ll need to create a market for zero emission aircraft, by taxing fossil jet fuel and mandating zero emission planes in the future. If we have to rely only on Airbus’ goodwill, hydrogen jets will never be more than a pipe dream.”

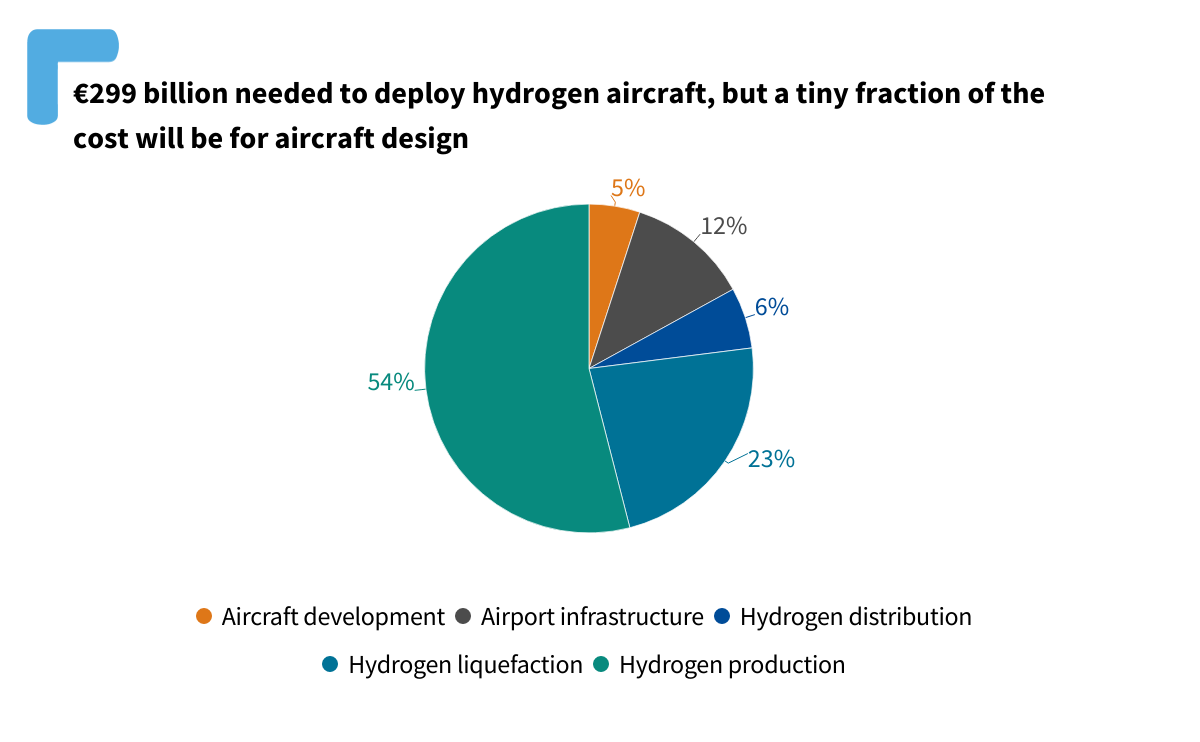

The analysis also shows that the total cost of deploying hydrogen aircraft for intra-European aviation would be €299 billion by 2050[3]. The development of hydrogen aircraft would only represent 5% of the cost (€15 billion)[4]. This relatively small upfront cost must however happen before 2035, or risks jeopardizing the success of these new planes.

The bulk of the spending will not lie within the sector. It instead relies on the wider development of the green hydrogen economy, which is developing in parallel. Over half of the cost (54% or €161 billion) will come down to the production of green hydrogen[5]. Another 23% will be needed for liquefaction of hydrogen – the process by which gaseous hydrogen is cooled at very low temperatures to become a liquid. Further costs lie in developing hydrogen infrastructure at airports (12%) and the distribution of the fuel to airports (6%).

The study also shows that the total cost could go down by €100 billion if leisure and business traffic remained respectively at 100% and 50% of 2019 levels. Reducing demand for business travel will not only be key to reduce emissions, but also to save costs, T&E says.

Technological hurdles around the development of hydrogen planes are significant. Liquid hydrogen has low energy density relative to kerosene, meaning that a larger volume of fuel is required to power the same distance. This limits the range of these aircraft, but hydrogen planes can still provide a viable alternative to decarbonise regional and short-haul routes, which represent 50% of Europe’s aviation emissions.

“There is no silver bullet to decarbonise aviation. Green fuels, demand reduction and hydrogen will all play a role. For hydrogen planes to take off in the next decade, we need to enter the virtuous circle of regulation, investment, a fall in prices, followed by stronger uptake. But the cost must be shouldered by the aviation industry and its users, by ring fencing part of carbon and kerosene tax revenues for green tech like zero emission planes and clean fuels,” concluded Carlos López de la Osa.

[1] If fossil kerosene is taxed in line with the Energy Taxation Directive proposal by the European Commission, at €10.75/GJ – approximately €0.37/L.

[2] The study considers jet aircraft using a fossil kerosene and Sustainable Aviation Fuel (SAF) blend.

[3] The study looks at costs needed for hydrogen for European aviation up until the year 2050, but further analysis is required to model scenarios for the next half of the century.

[4] This figure is an estimate based on previous new aircraft programme developments – for example, the Airbus A350 programme has been estimated at €12.5 billion over seven years (source). It includes the non recurring costs of aircraft design, testing and certification.

[5] The study assumed that all hydrogen will be produced in Europe.