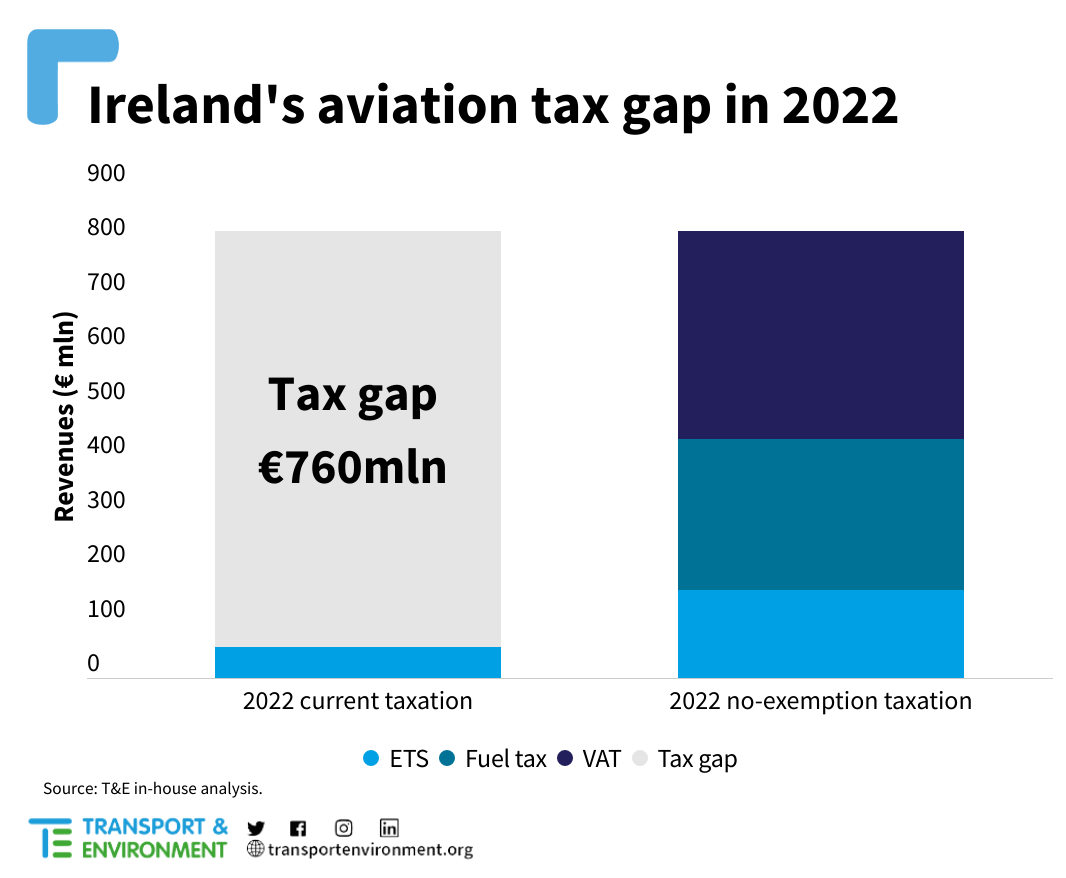

The Irish government lost out on €760 million in revenue last year due to very low levels of taxation in the aviation sector, a new study by green group Transport & Environment finds. €760 million could pay for the Government’s Renewable Electricity Support Scheme three times over. At European level, governments lost out on more than €34 billion in 2022 from the sector.

The analysis looks at the revenues that should have been raised from air travel pricing if the sector did not benefit from such exemptions. It compares these revenues with those that were actually raised in a year. This is defined as the ‘tax gap’. In Ireland, there is no kerosene taxation, no ticket taxes nor VAT and a carbon price on intra-European flights only. Ireland had a small tax on all departing flights from 2008 to 2014 but abolished it.

Of the €760 million gap, the Irish government lost out on €260 million from Aer Lingus’s activity alone. The study differentiates between charges on passengers and on airlines. Ticket taxes and VAT are imposed on passengers, whereas fuel taxes and carbon pricing are directly attributable to airlines. The study finds that Aer Lingus didn’t pay €140 million in fuel taxes and carbon pricing to its government.

Aoife O’Leary at Opportunity Green, explains: “Ireland is failing to reach its climate targets purely because it is not brave enough to require Ryanair and Aer Lingus to pay taxes. Aviation is the most carbon intensive form of transport and yet Ireland still failed to include aviation in its new Long Term Strategy on climate.”

Unless action is taken, the tax gap in Ireland will increase by 25% by 2025, as the sector is set to grow in coming years. Eurocontrol estimates that traffic will reach 92% of pre-COVID levels in 2023 and a full recovery by 2025. By then, the tax gap in Ireland could grow to €950 million, T&E finds.

Closing the gap and addressing aviation’s under-taxation should be an utmost priority for governments. The study recommends applying a fuel tax on kerosene, a 20% VAT rate on tickets and extending the carbon market for aviation to departing flights. These changes would help to close the gap in government budgets. In the absence of these measures, T&E recommends applying a ticket tax equivalent to the Irish tax gap, i.e. €950 million in 2025.

The study shows that higher taxes will have an impact on passenger ticket prices. This could result in a decrease in demand and CO2 emissions savings. The study finds that ending exemptions in 2022 would have saved 35 Mt of CO2, in Europe, with an even higher total climate impact accounting for non-CO2 effects of aviation. As the sector seeks to decarbonise, revenues raised by taxation should be partly reinvested in green technologies, such as e-kerosene. Aoife O’Leary concludes: “Irish Minister for the Environment, Eamon Ryan recently pointed out the injustice of aviation going untaxed while climate vulnerable countries require support to deal with the devastating impacts of climate change in their countries. Ireland must ensure aviation pays its fair share of taxes. There is a clear opportunity to reduce pollution from aviation and achieve Ireland’s climate goals, all while supporting those most at risk from climate disaster.“