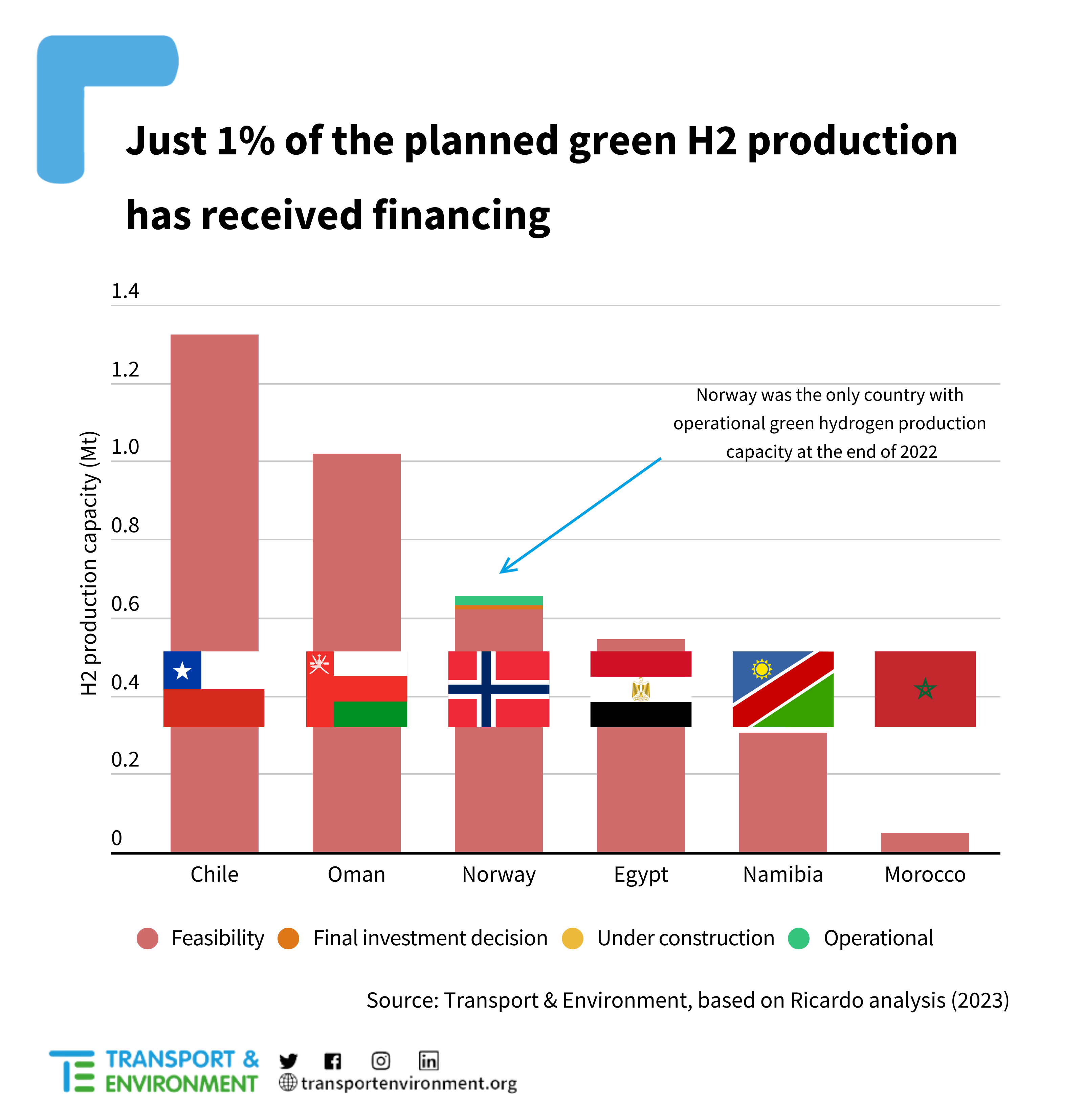

The EU should not rely on uncertain imports to meet its overly-ambitious hydrogen targets, a new study of six important export countries shows. Despite the big hype around hydrogen, just 1% of the planned green hydrogen production in the countries assessed has received financing. Europe should focus on developing its own supply before turning to countries which, in many cases, are not able to rapidly scale up hydrogen production and lack the necessary infrastructure to export hydrogen to Europe, says Transport & Environment (T&E).

Geert Decock, electricity & energy manager at T&E said: “With European politicians flying across the world to secure hydrogen deals, this is a much needed reality check. Most of the countries Europe is relying on for imports are not at all ready to scale up production.”

The EU’s RePowerEU, hastily decided following Russia’s invasion of Ukraine, sets out plans to produce 20 million tonnes of renewable hydrogen by 2030, with half of this coming from imports. The consultancy Ricardo on behalf of T&E looked at six countries with big plans to export hydrogen to the EU: Norway, Chile, Egypt, Morocco, Namibia and Oman. It estimates that these countries combined would only be able to deliver just a quarter of the 10 million tonnes of imports targeted by RePower EU.

Analysis of the national strategies of the six countries indicates that the EU is seen as a key market for hydrogen exports. Oman, for example, expects to export more than two thirds of its hydrogen production to the EU in 2030. But a major challenge is that these export countries – many heavily reliant on fossil fuels and water scarce – face major obstacles to scaling up production.

Clean electricity

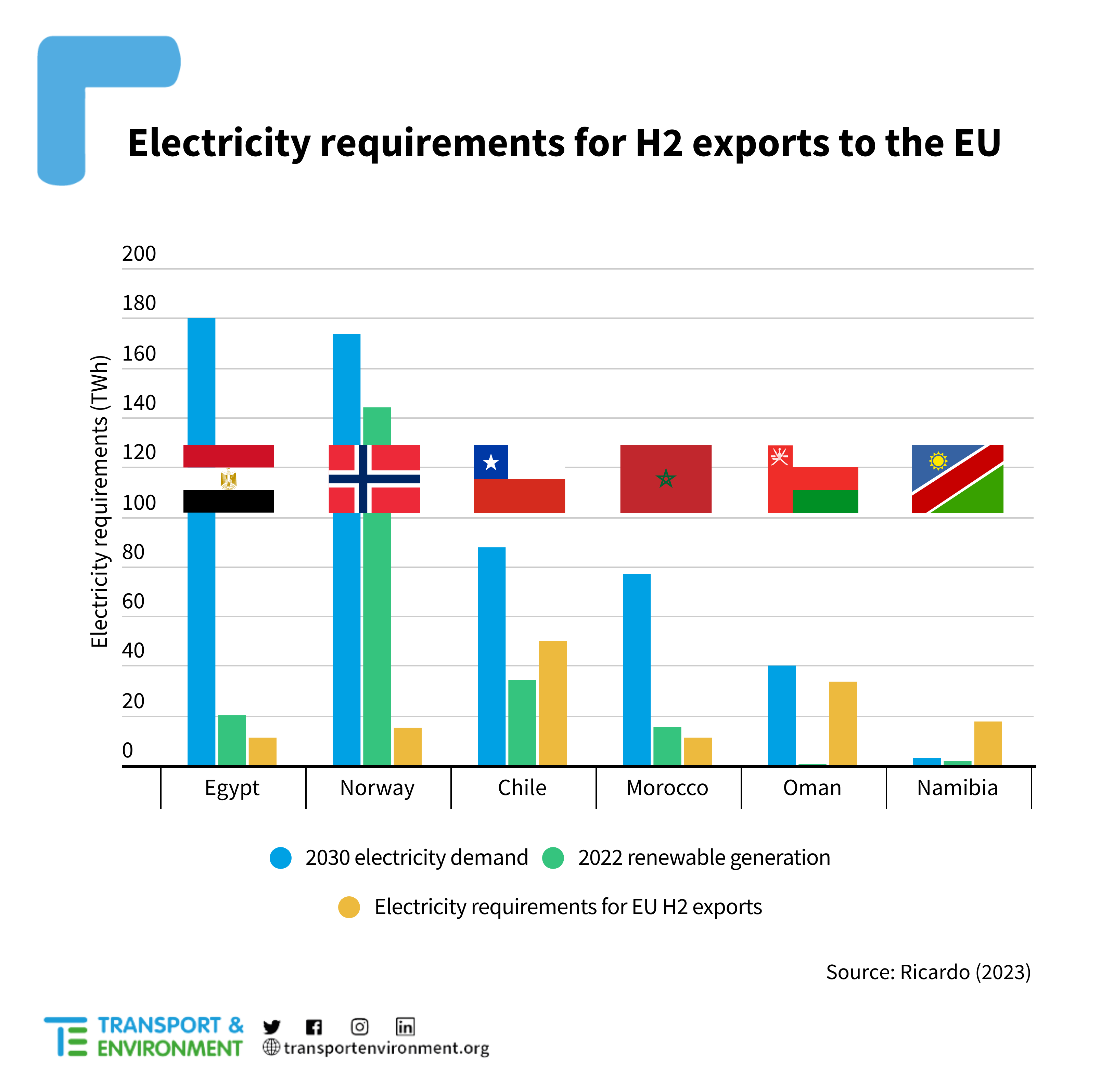

Aside from Norway, the other five countries currently have limited renewables capacity. Oman, for example, is almost exclusively reliant on fossil fuels to power its grid. These countries will therefore require huge investments in clean electricity generation to export green hydrogen as well as to decarbonise their own grids.

Namibia is the most extreme case, needing more than ten times the country’s projected 2030 electricity demands to meet its planned hydrogen exports to the EU. Half of Namibians currently have no access to electricity at all.

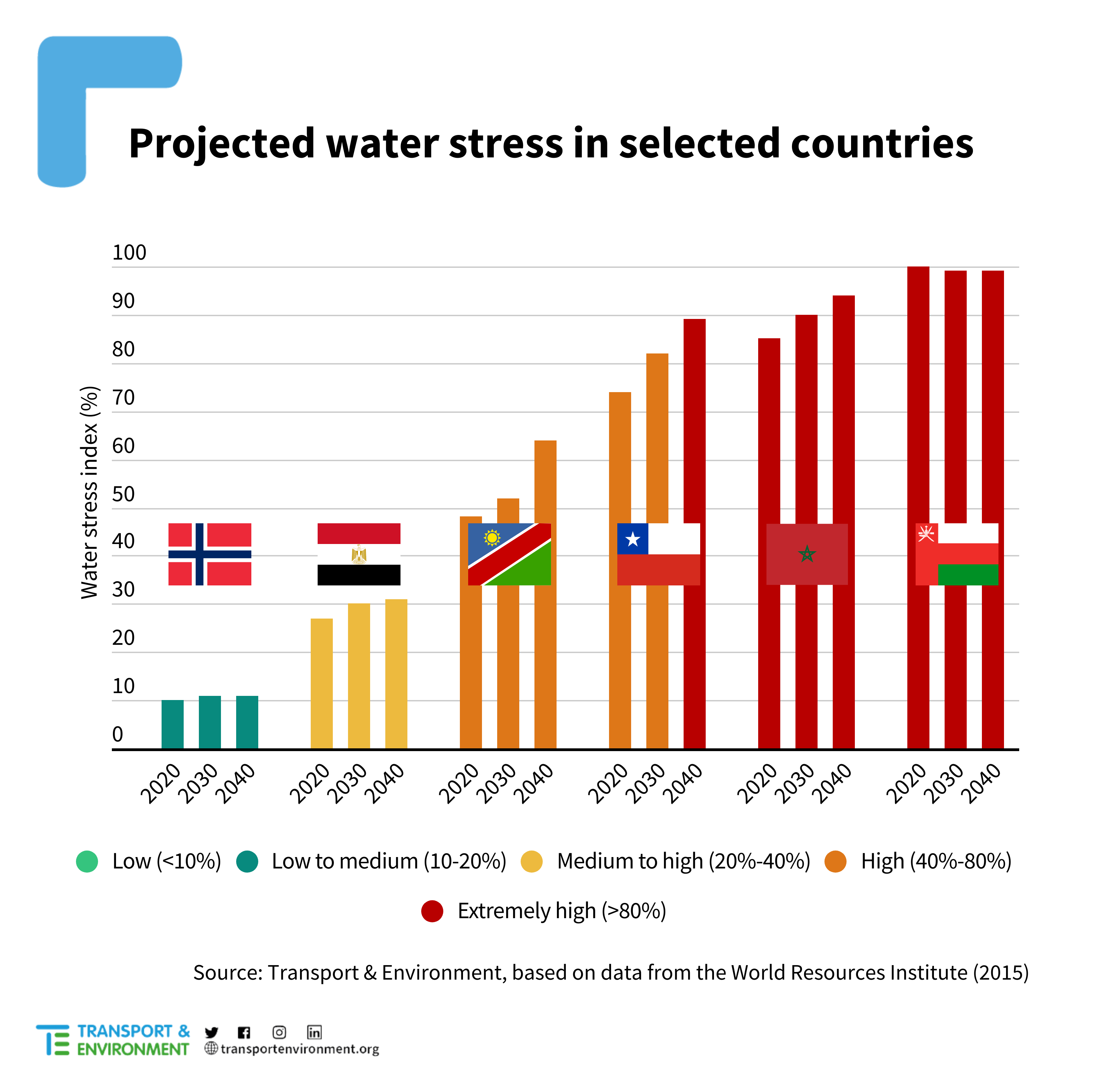

Water

Hydrogen also requires significant amounts of water. Between 55 and 80 million tonnes of water would be required to produce the 2.6 Mt of H2 planned to be exported to the EU in 2030 – the equivalent of 32,000 olympic swimming pools every year.All the countries looked at, except Norway, will face significant water scarcity in the decades to come.

Infrastructure

There is currently no infrastructure to transport hydrogen over long distances. Hydrogen pipelines, for example to North Africa, would take years to construct. This means the only viable way to import hydrogen currently is in the form of e-fuels such as e-ammonia, e-methanol and e-kerosene which can be moved around by ships.

EU production

Europe could produce between 6 and 7.5 million tonnes of renewable hydrogen by 2030 domestically. This would be enough to provide for the continent’s needs if it limits hydrogen and e-fuels supplies to sectors that have few other alternatives like shipping, aviation and fertilisers. According to the study, the EU’s hydrogen objectives are around five times what will actually be needed to hit the bloc’s 2030 green goals.

Geert Decock concluded: “The top priority right now is to develop a real market for renewable hydrogen and electrolysers in Europe. That’s a big enough challenge and will require a laser sharp focus on those sectors that need hydrogen most, in particular aviation and shipping. In the longer run hydrogen imports will need to play a bigger role, but there are a number of important conditions that need to be met for imports to be sustainable.”

The study shows that 2 million jobs could potentially be created in hydrogen supply chains in the EU by 2030, according to investments already announced.