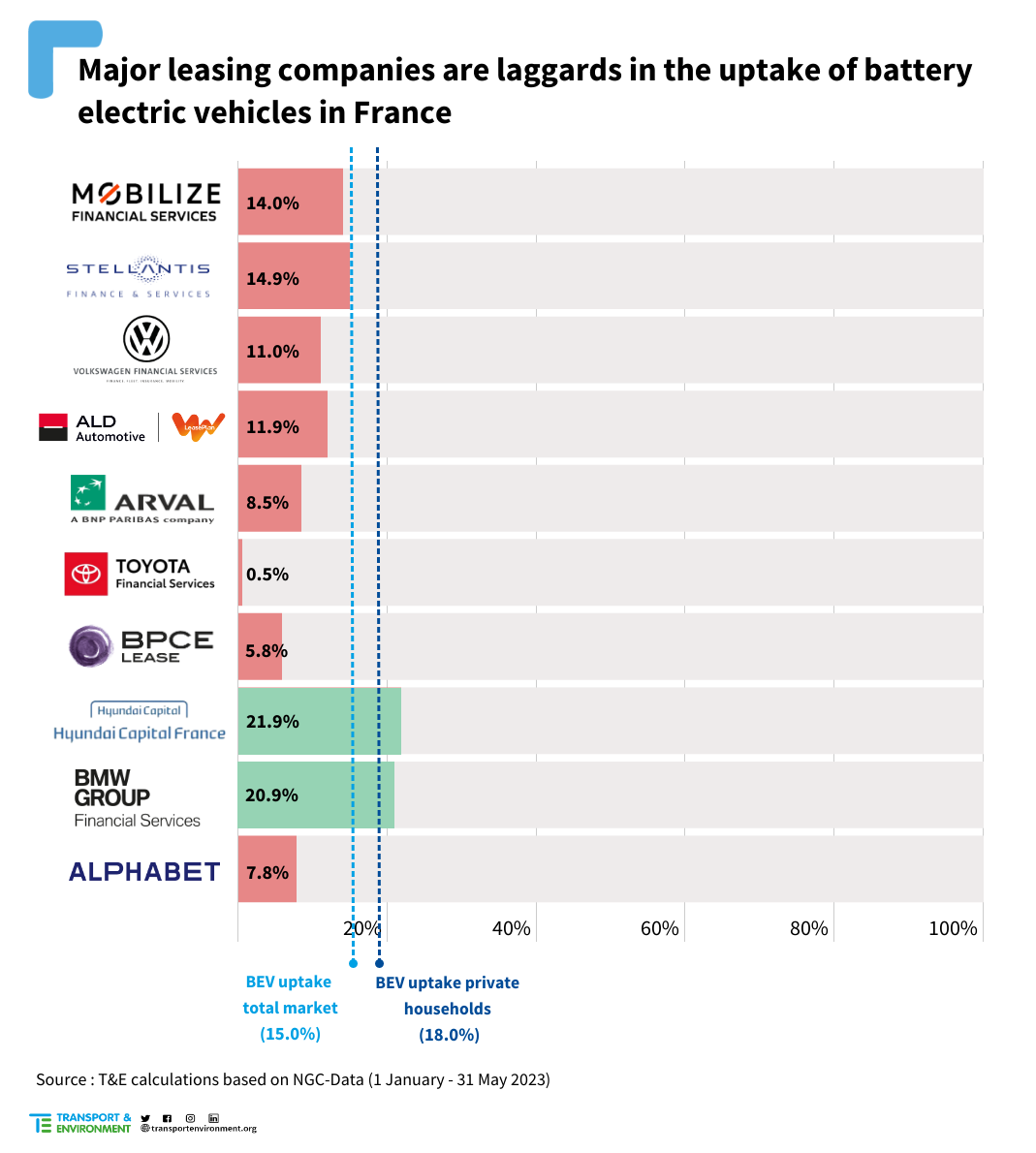

The leasing branches of some of France’s biggest banks and carmakers are lagging behind the new car market for the uptake of battery electric vehicles (BEV), a new analysis by T&E finds. None of the five biggest players in the French market – the leasing subsidiaries of Renault, Stellantis, Volkswagen, BNP Paribas and Société Générale – surpassed the 15% national average BEV uptake for the first five months of 2023. Worse still, they are all falling behind the uptake of battery electric cars in private households[1], which lies at 18% in France.

Among the top five, Arval (subsidiary of BNP Paribas) is performing the worst, with a BEV uptake of only 8.5%. Volkswagen Financial Services and ALD/Leaseplan (company that emerged from the recent merger of the Société Générale’s ALD and Leaseplan) follow close behind with a BEV uptake of 11% and 11.9% respectively. Mobilize Financial Services (Renault Group) and Stellantis Finance & Services edge closer to the national average with a 14% and 14.9% uptake.

The study finds that only two leasing companies – Hyundai Capital France and BMW Financial Services – have a higher uptake of BEVs than the 15% national average. Although they account for 2.5% of the overall market, they set a pace that other leasing companies should strive to emulate, T&E notes.

These figures spanning the first five months of the year confirm what was observed in 2022, where seven out of the ten biggest companies were falling behind the national average on uptake of BEVs.

Stef Cornelis, director of electric fleets at T&E, says: “Because they are so large, leasing companies have a huge power and influence over the cars we lease and drive. But with big power also comes big responsibility. Unfortunately the track record of the leasing laggards is poor: behind on electrification and no serious plans to change this.”

The study also finds that the problem is even bigger in the corporate leasing segment.[2] Indeed, the uptake of BEVs in corporate leasing is at a mere 8.5%, far behind the 15% national average.

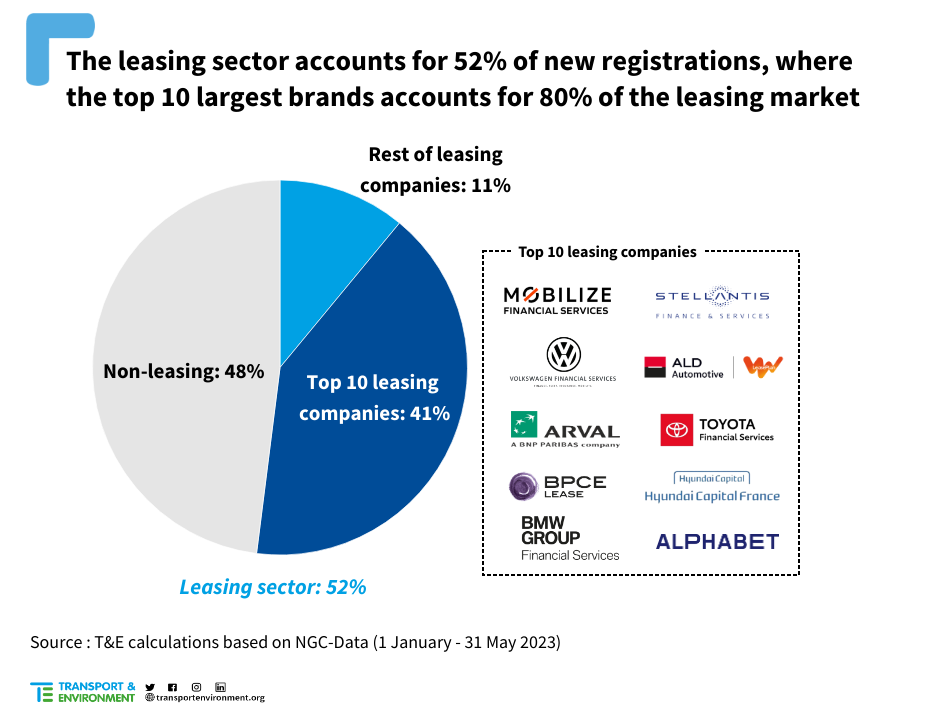

The findings of this study are all the more important because the leasing sector is the unknown giant of the automotive world. In 2023, over half (52%) of the new cars registered were leased in France. And the biggest players – the 10 companies analyzed in the study – accounted for 41% of all new registrations in France[3]. These brands have a crucial role to play in the shift to electric, but are so far lagging behind and not taking responsibility for the large share of emissions they cause.

Furthermore, the largest leasing companies are not transparent about the transition of their fleets. When asked, none of them disclose their share of battery electric vehicles. Some leasing companies report the share of “electrified vehicles” but this includes plug-in hybrids which have high real-world emissions. Similarly, none of them is committed to the transition to 100% battery electric vehicles.

Stef Cornelis concludes: “Leasing companies such as the new ALD / Leaseplan, Arval and Volkswagen Financial Services should finally take their responsibility, announce ambitious electrification targets and be the green mobility leaders they say they are. We don’t know if they are greenwashing or greenwishing, but they are certainly not leading the way for now.”

[1] Households that buy their cars directly, without going through the services of a leasing company.

[2] Leasing can happen for companies and individuals.

[3] In 2022, 59% of new cars registered were leased and the 10 companies analyzed in the study accounted for 46% of all new registrations in France.