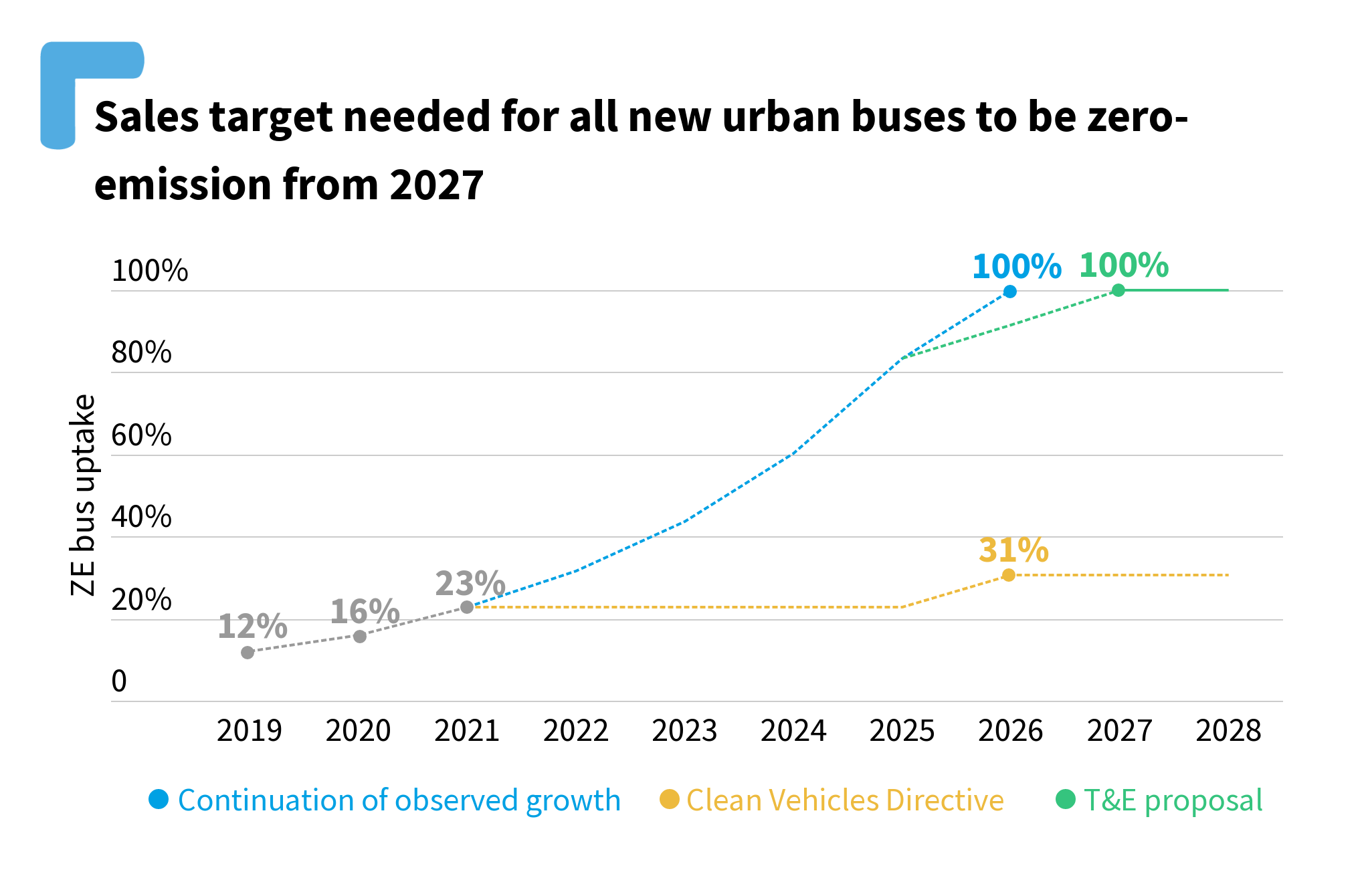

Cities are increasingly buying electric buses. Almost one in four newly-registered urban buses in 2021 was zero emission, according to new data. The last three years have recorded steady growth, with zero-emission buses accounting for 23% of buses registered in 2021, building on 16% in 2020, and 12% in 2019.

All very positive news. But how could we ensure that all new urban buses are zero emission as soon as possible? The current policy has dated quickly (the Clean Vehicles Directive will only bring zero emission bus sales above 30% after 2025), overtaken by the European Green Deal – and the yawning gap opening up between zero-emission bus demand and current targets (see infographic).

Cities are ditching fossil fuels fast – typically starting with their own public transport fleets – and they want more zero-emission buses ASAP. Some bus-makers are stepping up, with Daimler and MAN, for example, pledging that all their new urban buses will be zero emission by 2030.

If demand continues along its current growth path, European cities will want 100% of new urban buses to be zero emissions by 2026. The missing ingredient is an EU law that matches demand through a requirement on manufacturers to only supply zero emission buses.

Later this year the European Commission will publish a proposal to cut emissions from both new buses and trucks. This is the right tool to align buses with the Green Deal ambition and deliver an increasing supply of vehicles that drastically reduce emissions and air pollution. T&E is advocating for a 100% sales target for zero emission urban buses in 2027. That would put Europe in similar territory to California where all new urban buses must be zero emission from 2029.

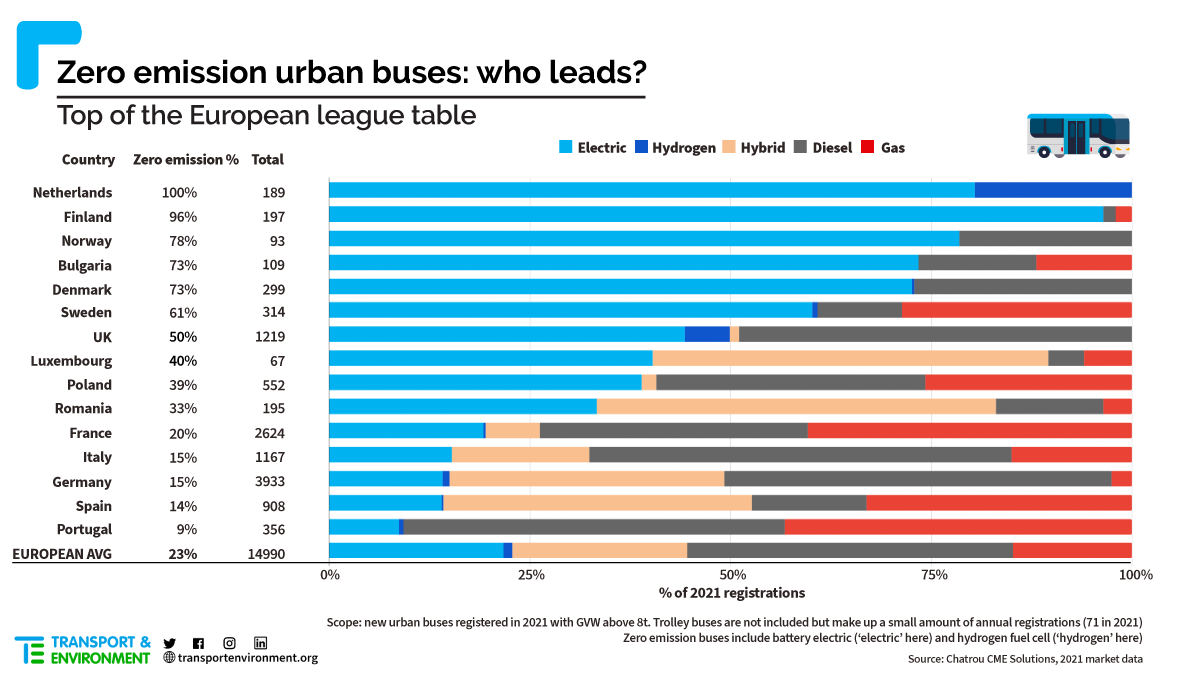

Which countries lead on zero emission bus deployment?

In 2021, all new urban buses registered in the Netherlands were zero emission. Other countries are catching up, notably Bulgaria, Denmark and Finland, which all recorded electric bus deployment rates of more than 70% last year.

Poland has made very strong progress, and four out of 10 of its new urban buses are now zero emission – far ahead of the comparable figures for Germany, Italy, Spain and France, where it’s not more than two out of 10.

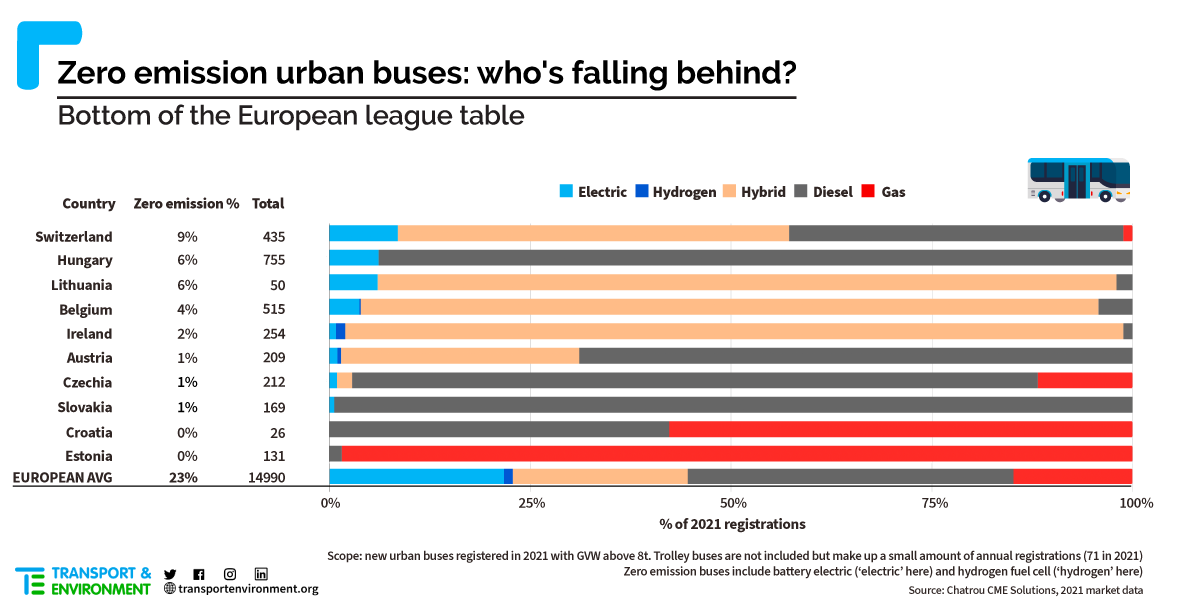

At the bottom of the league table are a handful of countries that still need to get out of the starting blocks on zero emission bus deployment, particularly Austria, Czechia, Slovakia, Croatia and Estonia.

Battery electric dominates

Electric and hydrogen are the two zero-emission powertrains. Electric dominates, making up 22% of all new registrations while hydrogen accounts for 1%. In London, which is decarbonising Europe’s largest urban bus fIeet, 90% of routes will go battery electric with overnight charging. For the other 10%, it’s a decision between: battery-powered buses topped up at a small number of stops en-route (‘opportunity charging’), a greater number of electric buses (with some topped up off-peak), or hydrogen, according to Transport for London.

Notwithstanding the strong progress on zero emission buses, there remains a lot of work to do. Some 77% of new urban buses in Europe are still either entirely fossil-fuelled (40% are diesel), or overwhelmingly fossil (22% hybrid and 15% gas).

Europe is leaving gas behind – except in France

Across Europe as a whole, new registrations of zero emission buses outnumber gas but, in France, it remains the other way around. (France registered more than 1,000 new gas buses, compared to just over new 500 electric buses). Italy’s 2021 market data may signal a move away from gas, where new-registered electric buses outnumbered gas for the first time last year.

In countries going electric, adoption is being helped by a growing awareness of lifetime costs, or ‘total costs of ownership’. Put simply, the upfront purchase price of electric buses is typically higher (than diesel, gas or hybrid), but day-to-day energy and maintenance costs are lower, meaning electric buses cost less over their lifetime.

European bus makers supply 75% of electric buses

Electric bus sales in Europe are dominated by European bus-makers, which account for around three-quarters of new electric bus registrations. It’s not a concentrated market, but spread among nine bus-makers, each with market shares of 5 – 12%. According to 2021 market data, Solaris leads with 12% of all new electric bus sales, followed by BYD-Alexander Dennis Ltd (11%) and Daimler (10%), with lower sales shares recorded by Yutong, Iveco / Heuliez, BYD China, Volvo, Irizar, and VDL. However, there’s major year-to-year variation, with key players regularly trading places.

Over to the European Commission

Seeing the robust growth in demand, some bus-makers are stepping up, with Daimler and MAN pledging that all their new urban buses will be zero emission by 2030. California, a touchstone for EU vehicle policy, has legislated that all new urban buses must be zero emission from 2029. To address air quality, the climate emergency and strong demand, T&E urges the European Commission to ensure that all new urban buses are zero emission from 2027.

The key takeaway is that the supply of zero emission urban buses will fail to meet demand without action by EU lawmakers in the forthcoming regulation. The European Commission proposal is due out on November 30.

This blog was first published by EurActiv.