.png)

Interested in this kind of news?

Receive them directly in your inbox. Delivered once a week.

Biofuels were once seen as the transport fuels of the future. But work by T&E and other environmental groups to expose the indirect damage caused by using food crops for fuel has led to some EU measures, such as palm oil for biodiesel, being phased out. It will no longer count towards EU renewable targets by 2030.

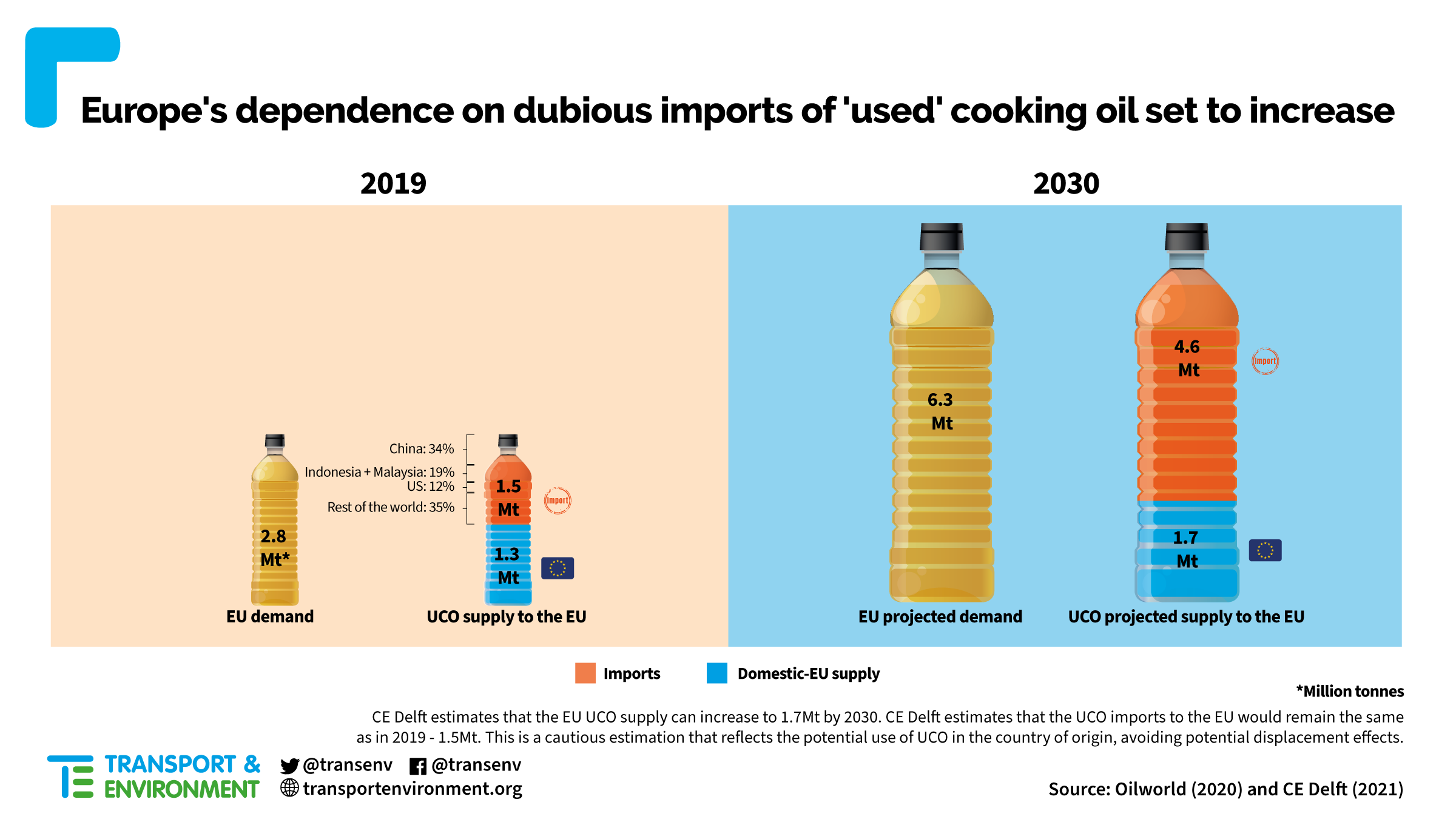

But it could find another way in, says T&E. The EU’s Renewable Energy Directive (RED) allows countries to double-count UCO towards national renewable energy targets; an incentive that means Europe’s demand for it could more than double by 2030. But as there is a limit to how much UCO Europeans can produce, it will be ever more reliant on imports to meet this growing demand.

China already supplies over a third (34%) of Europe’s UCO imports while almost a fifth (19%) comes from major palm oil producers Malaysia and Indonesia combined. Within a decade the volume Europe needs could double to 6 million tonnes as EU countries strive to meet targets for renewable fuels in transport, the study finds. This could trigger palm oil being used to replace cooking oil in exporting countries while also incentivising fraud (mixing virgin oil).

Cristina Mestre, biofuels manager at T&E, said: “Europe’s thirst for used cooking oil to power transport is outstripping the amount left over from the continent’s deep fryers. This leaves us reliant on a waste product being shipped from the other side of the world. The current EU system for biofuels does not provide certainty that used cooking oil is actually used. The controls need to be tightened, but more importantly the EU needs to limit the use of UCO to avoid doing more harm than good.”

The study comes as the list of countries phasing out palm oil faster than is required under the RED is growing. Belgium is the latest to announce it is phasing out biodiesel made from palm oil and soy within the next two years. Belgium thereby joins at least seven other major European economies phasing out palm oil faster than is required under the directive.

Belgium’s environment minister Zakia Khattabi said the decision to ban palm biodiesel from the Belgian market by mid-2022, and soy biodiesel from mid-2023, was taken because these fuels “lead to deforestation, loss of biodiversity, and even human rights violations.” She added “to produce the quantity of biodiesel for the Belgian market, palm oil plantations are needed with a total area of more than 100,000 football pitches.”

Mestre said: “Belgium’s decision shows the Commission that more and more countries want to move on from unsustainable fuels. Its decision to include a phase-out of soy is also helpful, as the RED doesn’t even mention soy as a high-risk biofuel.” But, she warns, “the EU also needs to make sure soy and palm don’t get in by the back door in the form of ‘waste’”.

The EU is due to begin a review of the RED in June. This is an opportunity for the Commission to phase-out palm oil earlier, while also tightening rules on used cooking oil, says T&E.