Interested in this kind of news?

Receive them directly in your inbox. Delivered once a week.

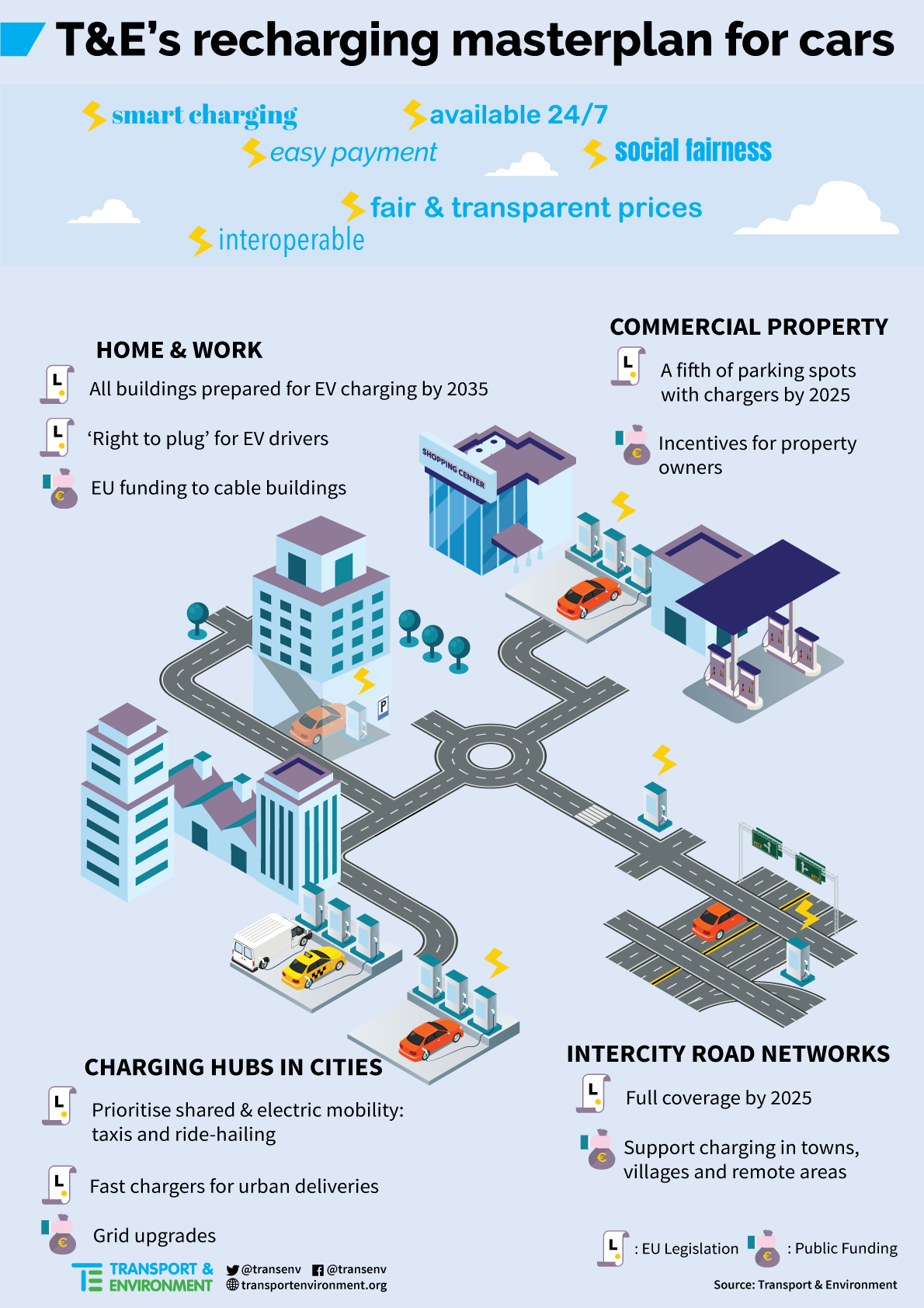

As of the end of 2019, there will be around 185,000 public charge points in the EU, or seven cars for each point, which is enough for the current market. But beyond 2020 much more charging infrastructure will be needed to keep pace with the growing e-mobility market. More effort is also needed to ensure seamless and reliable charging within and across countries for drivers. This is why it is crucial to revise the Directive in 2020 and turn it into a European Regulation to guarantee a swift harmonised pan-European deployment of public charge points in line with market developments. The charging deployment should be fairly spread across Europe to ensure all Europeans get the same chance to shift to zero-emission mobility.

To set an effective future-proof infrastructure framework, T&E has designed a new methodology – called the Public Charging Supply metric – on how to count and mandate infrastructure deployment across the member states in the new regulation. Instead of simply counting each charge point as one, T&E’s Supply Metric proposes to weigh charge points based on how much energy they can provide to the electric vehicle fleet and how available they are to the public. This metric should be used to set the EU public charging infrastructure deployment targets for each country for 2025 and 2030, corresponding to 1.3 million public charge points EU-wide in 2025 and close to 3 million in 2030. In total this would require investment of €1.8 billion in the year 2025, or only 3% of the EU’s annual investment in road transport infrastructure.

In making Recharge EU a flagship of the European Green Deal, the cabling and preparation of residential and workplace buildings for charging cannot be ignored. A European ‘right to plug’ should ensure that EV drivers wait no longer than three months to get charging, whether at home or work. This should go hand in hand with a funding programme to cable buildings and upgrade grids where necessary aiming at a fifth of buildings cabled in 2025 and half in 2030.

Finally, the supply of charging infrastructure in cities should be assessed in the light of the need to reduce the dependency on private cars. We need a transition towards fewer vehicles in urban areas so we need to prioritise the deployment of charging solutions for a growing fleet of shared cars, electric taxis and ride hailing services, as well as delivery electric trucks and vans. The latter might require significant investment to upgrade the grid at some locations which the EU and national funds should help with.

This transition will only be successful if it is a just and fair one, which will require social equity concerns to be reflected in EU and national policies, with dedicated shares (up to a third) of public and residential charge points provided in areas of low income or high air. Coupled with incentives to provide shared EV fleets in such areas this can help align mobility and social policy and ensure that everyone, including disadvantaged communities, benefit from zero emission mobility.

Overall, the shift to EVs will create a multi-billion euro market opportunity for European industry in the grid works and the manufacturing, installation, and maintenance of the charging equipment. The new European Commission and its EU Green Deal has a key role to play in making the transition to e-mobility a success. Not only is this transition essential to face the climate emergency, it will also serve as a building block for the EU’s transition towards a zero emission economy while boosting EU competitiveness.