This is a summary. To find out more, download the position paper.

Europe is losing ground in the global clean technology race. Unless decisive action is taken it will be exposed to ever greater dependencies, deindustrialisation and major job losses. Whether Europe adopts a much more forceful industrial policy now will determine whether it is able to achieve its economic, defence and climate goals.

The EU should ensure a significant share of critical electric technology stack (batteries, electronics, e-motors, chips, software and critical minerals) will be produced in Europe. Non-European firms can play an important role in this, provided they onshore their supply chains and enter in beneficial partnerships. This will not happen organically: the failure of the EU’s Net Zero Industry Act (NZIA) demonstrates aspirational domestic production targets without policy and funding do not make any difference on the ground.

Europe has many strengths. It has a large market for cleantech - e.g. one in five cars sold in 2025 are electric - and there are dozens of companies planning to produce battery components and minerals locally (Annex I), but many struggle to survive in the ramp-up phase or fail to secure offtake from carmakers because Chinese sourcing remains cheaper.

Local content requirements are essential to break this deadlock, and they can be scaled gradually as domestic capacity grows.

The forthcoming Industrial Accelerator Act (IAA) offers a critical opportunity to introduce simple, effective Made-in-EU and local content rules for electric vehicles (EVs) and batteries.

T&E proposes four pillars for a successful IAA:

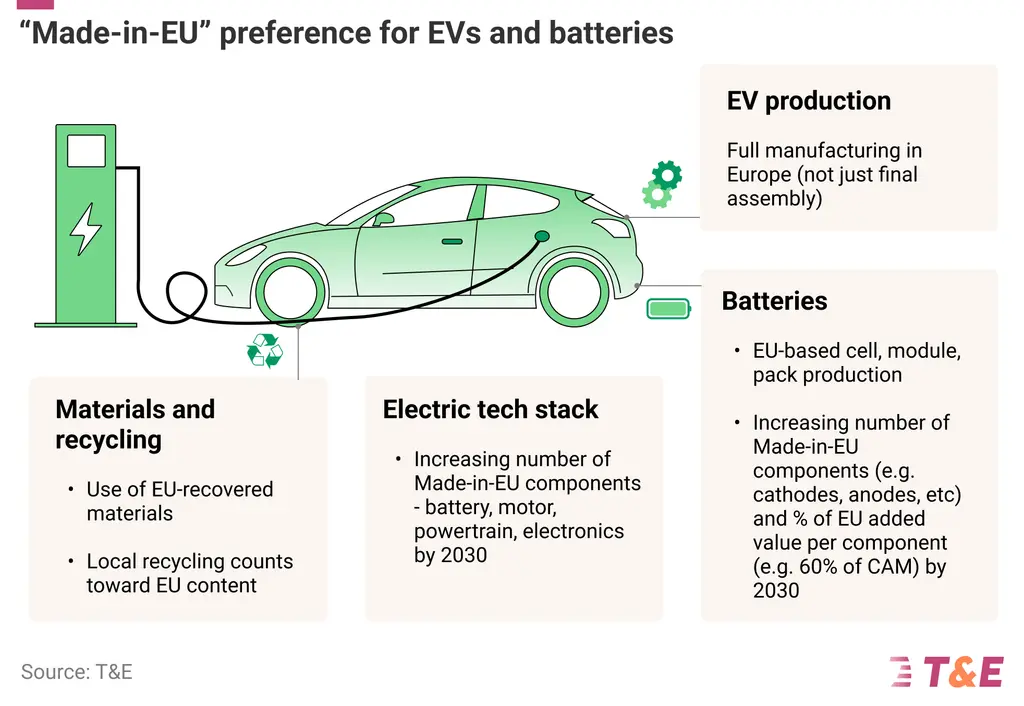

Define Made-in-EU rules for EVs and batteries

Europe must create lead markets for zero-emission vehicles while progressively developing domestic value chains. The IAA should clearly define what Made-in-EU EVs and batteries are. A transparent methodology rewarding Made-in-EU EVs, batteries, key components, and materials is necessary to create a clear business case that attracts private investment. These rules should above all focus on the electric tech stack - the strategic heart of a vehicle.

To build competitiveness and scale local clean manufacturing, mandatory Made-in-EU requirements should be progressively embedded across a spectrum of policies and financing instruments.

Link Made-in-EU rules to key policies, incentives and funding

Content rules should be simple, consistent and applied across a range of policy measures. Public procurement alone is too small to shape EVs and batteries’ markets. The EU’s key leverage lies in its single market and the billions of euros in national subsidies and state aid distributed annually. Local content requirements should therefore be tied not only to procurement, but also to national tax incentives, State Aid, EU funding, future corporate fleet legislation, car CO₂ standards, trade and if this combination does not deliver, market access.

Introduce a vehicle carbon footprint label and green steel label

A carbon footprint label for vehicles and key inputs (steel, aluminium, batteries) can drive market demand for clean, locally made materials and products. Labelling efforts should particularly support green steel offtake in the automotive sector, in a first instance. The IAA should commit to a vehicle carbon footprint label, based on a new steel carbon footprint label, the existing draft proposal for the battery carbon footprint and an upcoming aluminium carbon label. This vehicle carbon label should be first implemented via the Car Labelling directive review (planned for 2026) and to harmonise national fiscal rules (e.g. France’s eco-score). Incentives for the use of green steel could be provided in regulations such as the CO2 standards.

Ensure Foreign Direct Investment strengthens Europe’s industrial base

An EU-wide approach to foreign direct investment (FDI) in the EV value chain is essential. The IAA should define what counts as a meaningful technology transfer, ensuring that FDI contributes to resilience and competitiveness rather than deepening dependence. Since 2021, the European Commission has approved around €2 billion in State aid for Asian battery manufacturers, with more subsidies for Chinese players under consideration. This means a significant share of public support for Europe’s battery industry is flowing to non-European companies, with limited local value creation. Foreign EV and battery investments should only qualify for public support or trade benefits if they meet clear criteria: local control, technology and IP sharing, skills transfer, sourcing from local suppliers and local value requirements.