The increasing popularity of sustainable finance has given rise to a new dimension of business enterprise: ESG (Environmental, Social, Governance) data providers and raters, which play a crucial role in sustainable investing. Demand for ESG data is rapidly increasing, and is largely driven by both investors’ demand and new regulations setting ESG disclosure requirements for companies in the EU and the US in particular.

At present, high ESG scores are mistakenly believed by professional and retail investors alike to be indicators of sustainability or greenness. Well-rated companies are supposed to value and enact practices that put environmental and climate protection, social justice and inclusivity, and transparency in governance at the core of their business model.

However, it has been well documented over the last years that ESG scores are far from portraying a valid picture of a company’s green credentials. Instead of ensuring that the best performing companies get the recognition and financing they need, unregulated ESG ratings are misleading asset managers and investors. Ultimately, their flaws have exacerbated greenwashing on financial markets.

This is all the more visible in the transport sector, where large polluting companies, for instance carmakers, aircraft manufacturers or shipping companies, obtain remarkably high ratings. A major problem is that ESG scores are heavily focused on the assessment of the financial impact of sustainability risks for the corporation (outside-in materiality), and don’t take into account the impact the corporation has on nature and people which is relevant for wider financial stability risks and for policy objectives outside the field of finance.

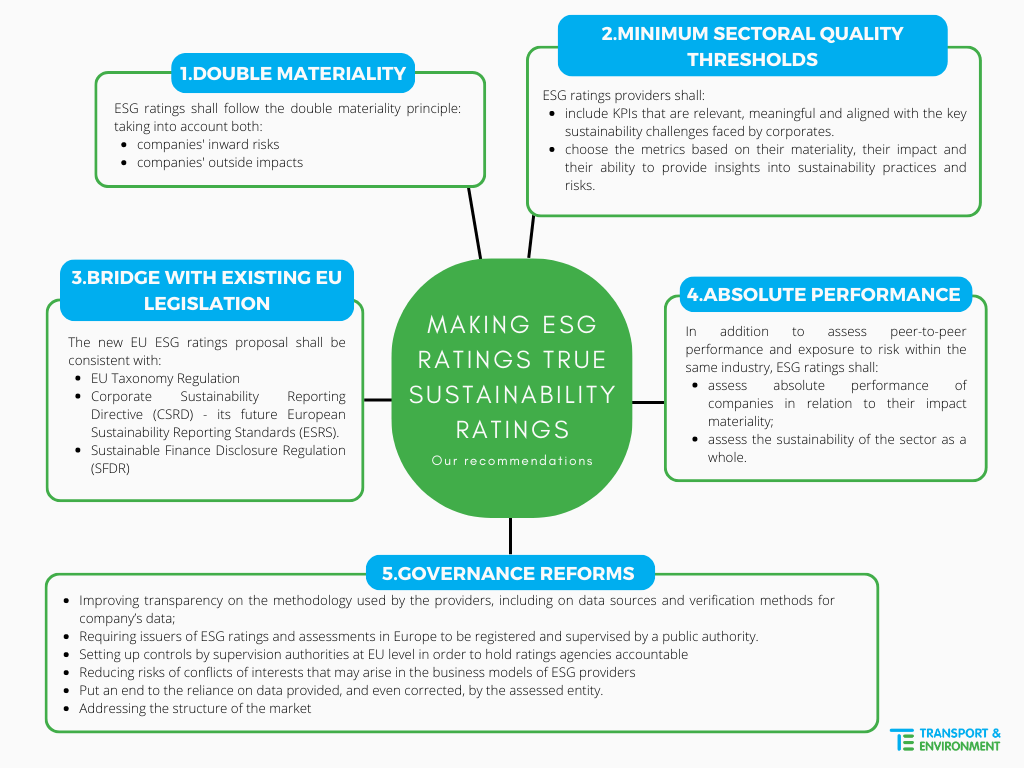

In this context, it is essential to overhaul the current system of ESG ratings and regulate this growing market in Europe, starting from ensuring consistency between ratings and establishing regulatory frameworks for the usability and impact of ESG data.

This paper addresses the inconsistency in ESG ratings and proposes recommendations to improve the European Commission’s proposal “on the transparency and integrity of Environmental, Social and Governance (ESG) rating activities” published on 13th June 2023.