Counting the tax deals for dirty diesel

Europe is a diesel island in the world. In the EU one in two cars sold is a diesel while outside it is one in 20. The tax treatment of diesel fuel is at the heart of the debate over ‘dirty diesel’ and leads to air quality problems where nine out of 10 new diesel cars sold fail to meet NOx limits when driven on the road.

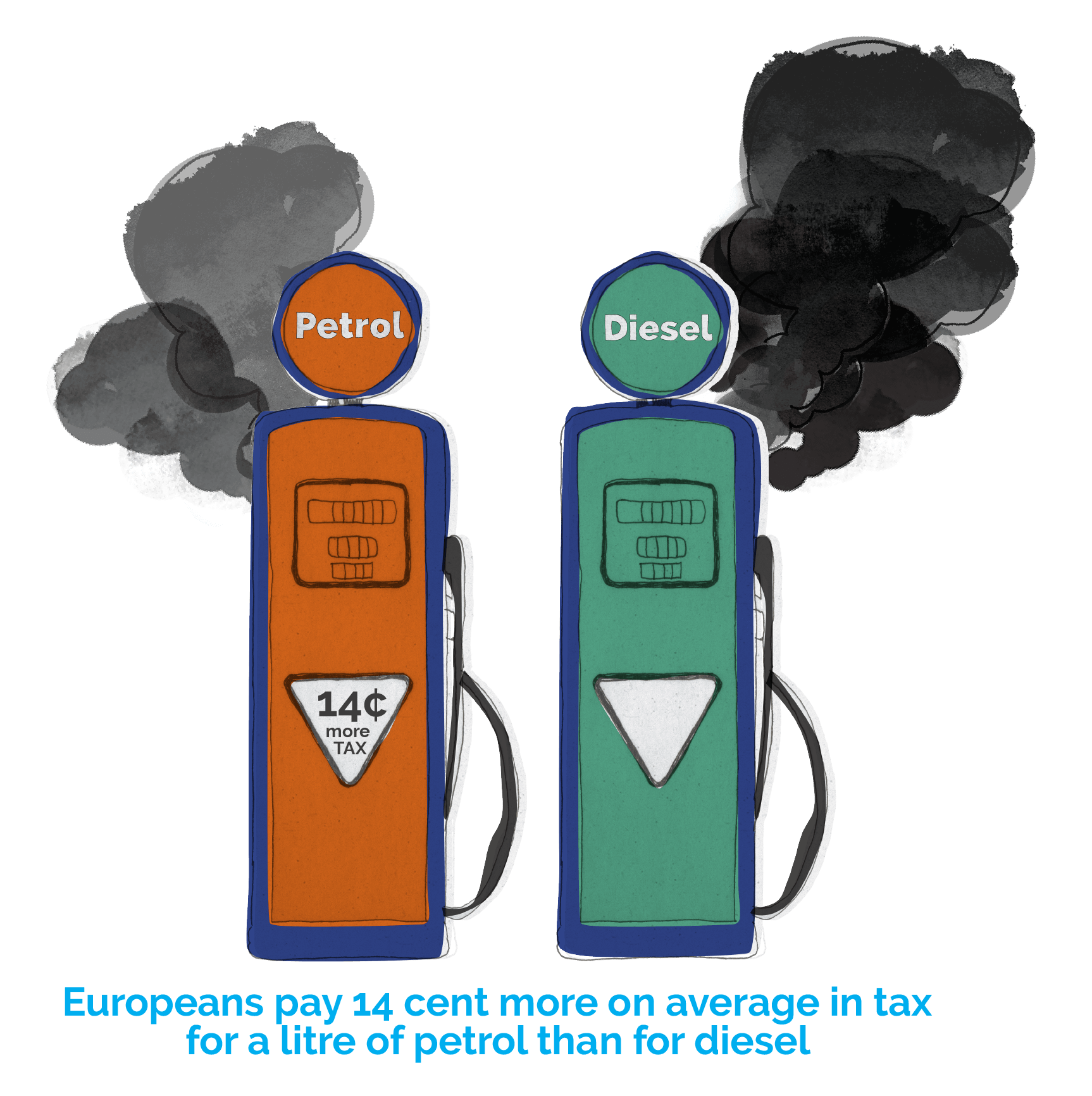

Historically Europe has taxed diesel more lightly than petrol, sowing the seeds for a boom in diesel car sales that started in the 1980s. As hopes of a binding European law on equal taxation faded in 2015, T&E saw the urgent need to inform policymakers of just how much we incentivise the technology through tax breaks. Our study, Europe's tax deals for diesel, found that Europeans pay 14 cent more on average in tax for a litre of petrol than for diesel – incentivising diesel cars through tax breaks to the order of €2,600 per vehicle. The overall fuel tax break for diesel cars amounts to an eye-watering €27 billion per year, with Germany and France alone accounting for more than half of this amount.

But some wrong ideas die hard: T&E still has a job to do in dispelling the car industry myth that lower diesel tax has been beneficial for the climate. In fact, the cheaper fuel has led to larger vehicles on our roads and additional mobility. And a diesel engine costs €2,000 more than a comparable petrol one; if that money were spent on hybridising the petrol engine, CO2 could be cut by much more than the 10-15% per km than diesel cars typically deliver. Thankfully, some European countries are beginning to rethink their diesel tax strategy. Belgium and France have started a multi-year drive to close the gap with petrol over the next few years. The UK already taxes diesel and petrol at the same rate per litre, though this means diesel is still taxed 10% less per unit of energy.

Our study also shed light on Europe’s truck diesel tax havens. With diesel used by trucks taxed even more lightly than for cars, 10 countries now tax truck diesel at or close to the EU minimum rate of 33 cent per litre – in a race to the bottom to get foreign trucks to fill up on their territory. Truck owners received a €4.5 billion rebate in 2014 on diesel fuel tax, with eight EU countries – Italy, France, Spain, Romania, Belgium, Hungary, Ireland and Slovenia – giving hauliers rebates on their diesel excise, up from one country in 2000. The fiscal dumping techniques not only undermine neighbouring countries’ tax revenues but also create a race to the bottom that runs completely counter to the EU’s ambition to reduce CO2 emissions and oil imports. Our message to lawmakers: with oil prices low, now is the time to act and finally align petrol and diesel taxes through a new energy tax directive.

“Days before the opening of global climate negotiations in Paris, it is clear that Europe has the capability to process these climate-killing fuels while the EU does nothing to stop them entering Europe”

“Days before the opening of global climate negotiations in Paris, it is clear that Europe has the capability to process these climate-killing fuels while the EU does nothing to stop them entering Europe”

– Laura Buffet, clean energy officer

EurActiv, 25 November 2015

While Europe fiddled as its diesel burned, the US dealt a blow to North America’s ultra-high carbon tar sands sector by rejecting plans to construct the Keystone XL pipeline. The project would have brought tar sands crude from Alberta, Canada to America’s Gulf Coast refineries. From there the fuel – the extraction and refining of which produces three to four times more global warming emissions than conventional crude – could have been shipped to Europe. But despite the decision, Europe remains a prospective market for tar sands – from Canada and elsewhere. As ever with the oil industry, information is as transparent as the crude itself. T&E and Friends of the Earth Europe sought to clean up matters with an assessment of Europe’s refineries: which facilities were ready to process the climate-killing fuel. The resulting map shows Europeans which refineries in their region are equipped, allowing them to lobby their political representatives to keep tar sands out.

Early in 2015 the EU finally published, after years of delay, the Fuel Quality Directive which originally was intended to encourage use of greener road fuels. Much weakened under pressure from North America and the oil industry, it still requires European governments to track and report dirtier types of oil; a basis for further action after 2020.

Learn more

http://www.transportenvironment.org/what-we-do/dirty-oil