How not to lose it all

Two-thirds of Europe’s planned battery production is at risk without further action, a new T&E analysis finds.

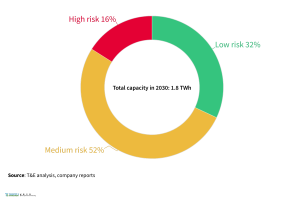

Close to 50 lithium-ion battery factories are planned for Europe by 2030, but US subsidies and other factors pose a new threat to these nascent projects. T&E looked at project maturity, funding, permits and companies’ links to the US to analyse how much of Europe’s 1.8 TWh battery factory potential is at risk.

Key findings

- 68% of potential battery production capacity in Europe (1.2TWh) is at risk of being delayed, scaled down or not realised if further action is not taken

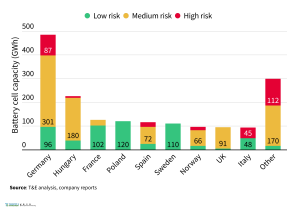

- Tesla in Berlin, Northvolt in northern Germany and Italvolt near Turin are among the projects that stand to lose the greatest volumes of their planned capacity

- Germany, Hungary, Spain, Italy and the UK have the largest shares of battery cell capacities at risk

- To counter US subsidies, Europe needs a strong response including faster approvals for best-in-class projects and EU-wide funds that are easily accessible and focused on production scale-up.

Almost 70% of European battery cell capacity is at risk

Europe’s leading climate rules, such as the Fit for 55 package, meant the continent has led in global cleantech investments until recently. Dozens of billions have poured into scaling electric vehicle (EV) manufacturing, batteries and component manufacturing. As a result, over half of all lithium-ion batteries (LIB) the EU used in 2022 were already produced locally, with close to 50 gigafactories planned by 2030.

But on top of China’s dominance in EV supply chains, the US Inflation Reduction Act – that pours at least USD 150 bln into batteries components and metals manufactured in the US (or friendly countries) – is changing the rules of the game fast. In terms of global investment into LIB tracked by BloombergNEF, Europe’s share dropped from 41% in 2021 to a meagre 2% in 2022, while investment in China and the US continued to grow.

In theory, one might argue that European and American battery supply chains can develop in parallel and benefit from efficiencies. In practice, skilled workforce, company capital to invest in procurement and permits, and above all supply of raw materials such as lithium, are all in short supply. This means the global race to capture battery manufacturing is in reality more of a zero sum game. Companies from Northvolt, to Polestar to Iberdrola have already signalled expanding in the US.

Using an in-house methodology that looks at project maturity, funding, permits and links to the US, T&E has analysed how much of Europe’s 1.8 TWh battery factory pipeline potential is at risk. The analysis reveals that around a fifth (or 285 GWh) of the announced projects are at high risk, and a further 52% (or around 910 GWh) at medium risk. Overall, almost 70% of the potential battery cell supply in Europe is at risk. The projects might be delayed, scaled down or not realised at all if further action is not taken.

This includes projects such as Northvolt in Germany and Italvolt in Italy.

Germany, Hungary and Spain have the largest battery cell capacities at risk

Europe needs to put in place a robust green industrial policy to capture the economic, technology and jobs value from the energy transition. This should leverage Europe’s strengths such as strong climate regulations on electric cars, vans and trucks to create investment certainty; as well as introduce a green simplification agenda to allow for faster approvals for best-in-class projects – e.g. more staff, better expertise and digitalisation – without undermining environmental safeguards. Above all, to be effective Europe’s response should mirror the US IRA in focus, simplicity and visibility. Given limited resources, prioritisation should be on battery value chains (notably cells, components such as cathodes and processing of critical metals into those), renewables such as wind and smart grids. Europe won’t compete in these without a robust European financial framework (e.g. via the European Sovereignty Fund and reallocation of EU recovery and other funds in the short-term) that has sufficient money, focuses on production scale-up and is easy to access by companies.

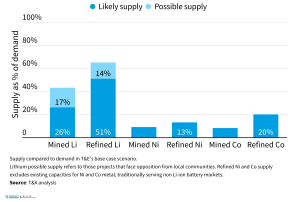

Wherever Europe’s ambition in battery supply chains is discussed, the question arises around raw materials availability. Europe is not a mining super power, but a combination of responsibly sourced global imports, sustainable domestic projects and, above all, critical metals coming from waste streams can help the bloc secure access. Looking at the domestic projects to extract lithium, nickel and cobalt in the pipeline, Europe can secure around 10% of its needs for nickel and cobalt in 2030 from local mining. In the case of lithium, especially thanks to cleaner technologies such as direct extraction from geothermal brines, half of Europe’s needs can be met.

Europe can extract up to half of its Li demand and around 10% of Ni and Co demand by 2030

The upcoming Critical Raw Materials act should help capture this potential in a socially and environmentally sound way. Goals on self-sufficiency, including refining and recycling, should be set and achieved via “strategic projects” and targeted support. Our large consumer market means that potential to recycle faulty or used battery cells, as well as scrap from upcoming battery factories or waste streams from old mine sites, is as large as domestic extraction.

In short, China’s dominance and the US IRA pose a serious risk to Europe’s ambition in the battery value chain. But if Europe acts quickly and overcomes its inertia by introducing a targeted, strong and sustainability focused framework, it can still keep in the race.

Key recommendations

- To create investment certainty, Europe should lock-in the 2035 engine phase-out for new cars and vans and introduce a similar deadline for trucks.

- Prioritise the battery value chain – including cell and component manufacturing, critical metals refining and processing – in the upcoming Net Zero Industrial Act and financing.

- Simplify permitting and approval processes for battery value chain projects, while ensuring strong social and environmental safeguards and engagement of local communities.

- Provide simple tax breaks and production aid for best-in-class projects and reward accelerated implementation of the carbon footprint, circularity and due diligence provisions in the new EU Battery regulation.

- Additional funding at EU level is necessary to support successful projects across Europe, e.g. via the Recovery and Resilience funds in the short term and the European Sovereignty Fund in the mid- and long-term.

- Ensure diversified raw materials sourcing via the new Critical Raw Materials Act by prioritising European projects in refining, processing and recycling, while working with partners to import responsibly sourced materials.