The world has changed. Energy use will too

Renewables continued to take an ever greater energy share in 2020. But with biomass burning on the up, too, the fight over the right kind of renewables continues. And while T&E was helping to ensure more zero emissions vehicles were on the road than ever before, oil came down from its 2019 high. We may never see those highs again. Meanwhile, hydrogen was the year’s buzzword, but the debate over its precise role in transport decarbonisation remains open.

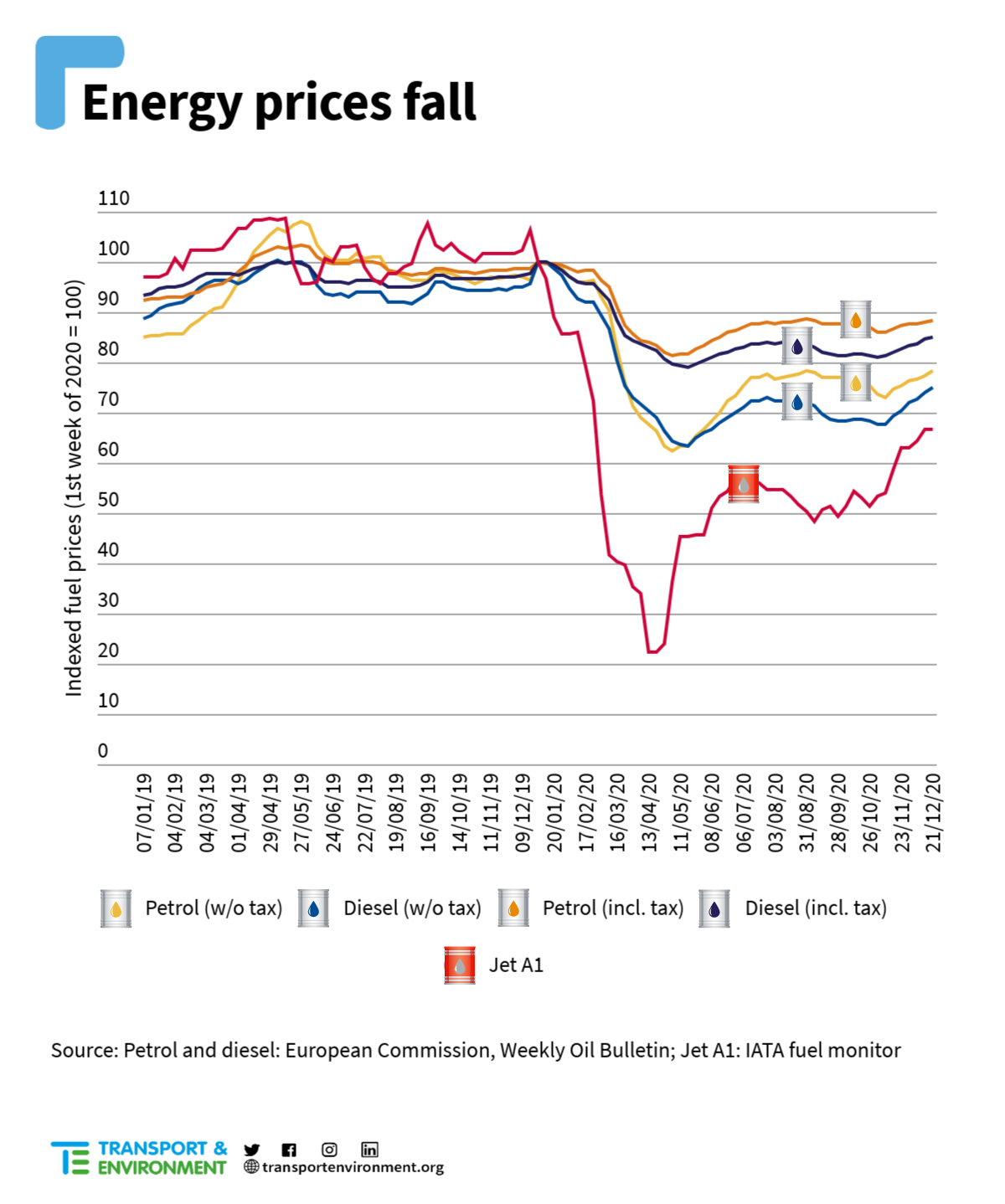

The year that oil demand sank

Because of lockdowns and travel restrictions, global oil demand dropped by 29 millions barrels per day in April 2020, the worst fall in the history of the oil markets. 2020 was also the year when something unprecedented happened. US oil prices dropped below zero for the first time in history due to oversupply and limited storage capacity. Demand across the world remains low. Only reduced supply is dragging prices back up.

The impacts of the 2020 pandemic, especially the economic crisis, will be felt for years with many societal changes set to endure. Business travel could be widely replaced by Zoom and Teams, and the morning commute may never be the same again as workers get used to home comforts. Other changes could be more damaging, however, with home deliveries surging. The world has changed. Energy use will too.

The EU’s hydrogen push

In 2020, hydrogen made it high on the EU agenda. In July, the European Commission released its hydrogen strategy as a clear signal for prioritising hydrogen use in hard-to-decarbonize sectors like aviation and shipping. Unfortunately, however, the Commission left the door open to supporting fossil-based hydrogen. Later in the year, T&E released a report by Ricardo Energy emphasising the importance of efficiency. The report concluded electrofuels would be wasted on cars while it is badly needed to decarbonise planes and ships. Powering just 10% of cars, vans and small trucks with hydrogen and 10% with e-diesel would require 41% more renewables in 2050 than if they were electric vehicles running on batteries, according to the study.

The fight against biofuels goes on

Biofuels such as palm oil continue to present a major challenge. According to a study for the European Commission, biodiesel from palm is three times worse for the climate than regular diesel when indirect emissions are accounted for, while soy diesel is two times worse.

Early in the year T&E participated in the lawsuit which led to Italian oil giant Eni being slapped with a €5 million fine over its greenwashing of palm-oil based diesel as ‘green’. The company ran a marketing campaign that deceived consumers by claiming its ‘Eni Diesel+’ has a positive impact on the environment.

Following this, the company announced it would ditch palm oil diesel by 2023. In a written response to Italian T&E member Legambiente, submitted for their annual general meeting, the energy company stated: ‘As part of its decarbonisation strategy, Eni is substantially reviewing its supply chain in order to eliminate the use of palm oil and PFAD by 2023’.

A T&E study brought this much closer to home by showing that European drivers burn 100 times more palm oil in their tanks than is in the 40 billion Oreo cookies consumed worldwide every year. It found that the amount of forest-ravaging palm oil used to make EU ‘bio’-diesel increased 7% the year before, reaching an all-time high of 4.5 million tonnes.

Growing evidence that indirect land-use impacts made some biofuels worse for climate change than diesel has led to a change of policy direction, notably away from palm oil. But it isn’t just palm oil. As use of palm oil is expected to recede between now and 2030, the gap in the EU biofuels market is likely to be filled by soy, which presents its own deforestation problems.

Mindful of this danger, T&E commissioned a report by expert consultancy Cerulogy, which shows that soy cultivation is a major cause of deforestation in the Amazon and other critical ecosystems in Latin America, and that additional demand for soy diesel as a biofuel on the European market would exacerbate the problem. Based on this new piece of evidence, T&E is asking soy biodiesel to be phased-out, together with palm oil, as soon as possible.

The fight goes on.

Progressive measures on biofuels at the national level

At the national level, countries are moving forward with more progressive measures on biofuels, setting earlier dates for ending the support of palm oil in diesel than what the EU requires.

France decided early on to end the tax incentives to palm biodiesel and it recently extended the measure to soy and palm derivatives. Italy is considering similar measures to apply from 2023 onwards. Meanwhile, Denmark adopted measures to end the accounting of palm oil biofuels towards its renewable targets from 2021. More recently, Germany announced that incentives for the use of biodiesel made from palm oil would end by 2026 - four years ahead of the EU’s phase-out date.

#Together4Forests

The #Together4Forests campaign supported by T&E saw more than a million people call for a strong, new EU law to stop EU-driven deforestation, sending a powerful signal to the European Commission and national governments - the second largest public consultation on environmental issues in the history of the EU.

T&E will continue to accelerate the transition away from oil - and from crop biofuels.